- NZD/JPY has taken support at 20-DMA at 82.22 and edged higher to currently trade at 82.54 levels.

- Moving averages do not show signs of reversal as of now, price action rages between 5 and 20 DMAs.

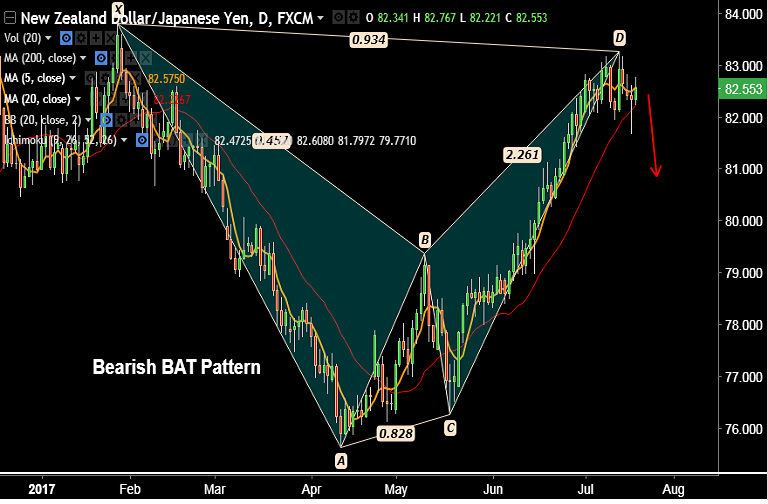

- We see a 'Bearish Bat Pattern' on daily charts, raises scope for downside in the pair.

- Back-to-back Doji formations on weekly charts also supports downside bias.

- Decisive close below 20-DMA could see downside, drag upto 38.2% Fib of 76.270 to 83.272 rally) then likely.

Support levels - 82.30 (Weekly 5-SMA), 82.22 (20-DMA), 81.67 (July 18 low)

Resistance levels - 82.87 (88.6% Fib retrace of 83.809 to 75.626 fall), 83, 83.27 (July 13 high)

Recommendation: Good to go short on close below 20-DMA at 82.22, SL: 82.60, TP: 81.70/ 81/ 80.70

FxWirePro Currency Strength Index: FxWirePro's Hourly NZD Spot Index was at -2.90181 (Neutral), while Hourly JPY Spot Index was at 49.7036 (Neutral) at 0820 GMT. For more details on FxWirePro's Currency Strength Index, visit http://www.fxwirepro.com/currencyindex.

FxWirePro launches Absolute Return Managed Program. For more details, visit http://www.fxwirepro.com/invest