The RBA and RBNZ appeared to diverge markedly in the recent monetary policy meetings, with the former signaling a near-term pause on easing and messaging steady while the latter surprised with 50 basis points of cuts. Still, we expect both central banks to remain accommodative over the medium-term. The RBA SoMP baked in two cuts in its forecasts, as expected, and even despite that adjustment does not predict meeting its unemployment or inflation objective. Furthermore, Gov. Lowe has reiterated his recent ‘low for long’ expectation and has posited reaching the zero lower bound as a possibility. For now, the RBA retains its easing bias even despite a potential near-term hold.

Meanwhile, the RBNZ has demonstrated its willingness to accommodate aggressively under its new governor, and we expect them to continue their easing cycle later this year in November – especially as bank capital regulation changes begin to set in. Further easing will drive real rates to -1% and should help anchor weakness in both currencies.

Furthermore, AUD and NZD should both remain under pressure as the US-China trade war creates adverse trade outcomes for other regional partners (refer 1st chart), and continue to force down yields amid higher central bank easing expectations. Neither currency performs well during Fed easing cycles, for example, and both are still prone to the downside so long as global growth indicators continue to slump. A new wrinkle, however, is the sudden depreciation in CNY which has challenged risk sentiment and will likely dent already-slowing demand for imports. And despite the confluence of mostly-negative global developments

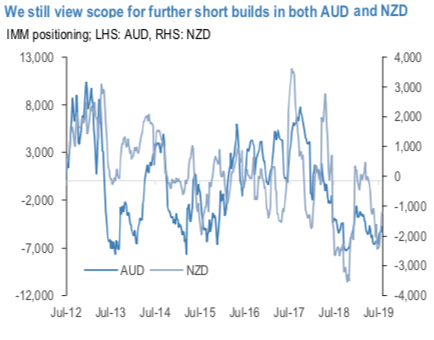

along with full-fledged antipodean easing cycles, we don’t view positioning metrics as especially stretched (refer 2nd chart). This should create enough room to let both currencies continue their downward medium-term slide. Near-term drivers to keep an eye on including the ongoing collapse in iron ore prices, AUD data (employment 14-15 Aug and GDP 9 Sept) NZD housing news.

Trade tips:

Stay short NZDUSD in cash. Marked at +0.81%.

Stay short AUDJPY in cash. Marked at +0.67%.

Uphold NZDJPY shorts via 6m put spread. Paid 1.07% at the end of May. Marked at +1.56%. Courtesy: JPM

Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios

Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios  US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts  Energy Sector Outlook 2025: AI's Role and Market Dynamics

Energy Sector Outlook 2025: AI's Role and Market Dynamics  European Stocks Rally on Chinese Growth and Mining Merger Speculation

European Stocks Rally on Chinese Growth and Mining Merger Speculation  Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms  S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays  U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?  Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data  U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge  2025 Market Outlook: Key January Events to Watch

2025 Market Outlook: Key January Events to Watch  US Gas Market Poised for Supercycle: Bernstein Analysts

US Gas Market Poised for Supercycle: Bernstein Analysts  Urban studies: Doing research when every city is different

Urban studies: Doing research when every city is different  Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close  UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty  China’s Growth Faces Structural Challenges Amid Doubts Over Data

China’s Growth Faces Structural Challenges Amid Doubts Over Data  Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes  U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures