Yesterday ECB President Mario Draghi opened the annual ECB conference in Sintra, Portugal and will speak again this morning as the first speaker at this conference. His infamous speech delivered in Sintra last year is likely to be fresh in many people’s memory.

At the time his optimistic view on the eurozone economy was interpreted as a signal for an imminent end of the ultra-expansionary monetary policy. As a result, the euro appreciated significantly. One year on things looks a little different though.

Last week the ECB really did announce the end of the asset purchases, but an actual end of the expansionary monetary policy is not really in sight. Rate hikes, which are what the market really wants to see, are still a long way off, as the ECB has pointed out very clearly. It can therefore not be assumed that Draghi will move the markets to the same extent today as he did last year.

Bearish EURJPY scenarios (see 126) if:

1) The Growth fails to rebound above 2%

2) EUR appreciation and/or sluggish core CPI delays ECB policy normalization

3) The BoJ does not move even if core inflation rate rises more than expected.

OTC outlook:

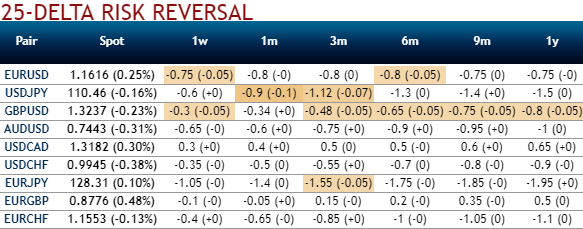

Most importantly, please be noted that the positively skewed IVs of 3m tenors are signifying the hedging interests in the bearish risks. The bids for OTM puts of these tenors signal that the underlying spot FX likely to break below 123 levels so that OTM instruments would expire in-the-money.

While mounting negative risk reversal numbers of 3m tenors are also substantiating bearish risks in long run amid minor abrupt upswings in the short-term.

Technically, we already raised red flags about EURJPY bearish risks. For more readings, refer below website: https://www.econotimes.com/FxWirePro-EUR-JPY-bears-win-trades-in-tussle-between-hammer-and-shooting-star--Trade-one-touch-puts-and-short-hedge-on-bearish-engulfing-1375673

Options strategies for hedging:

Contemplating above fundamental driving forces and OTC indications, we’ve devised various options strategies:

Buy 2M EUR puts/JPY calls vs. sell 2M 28D EUR puts/KRW calls for directional traders.

Buy 2m EURJPY ATM -0.49 delta puts for aggressive bears on hedging grounds. If expiry is not near, delta movement wouldn’t be 1 point increase with 1 pip in the underlying spot FX. Which means if the spot FX moves 1 pip, depending on the strike price of the option, the option would also move less than 1.

Sell 4M EURJPY 25D risk-reversal (buy EUR calls - sell EUR puts), delta-hedged for risk-averse traders.

Currency Strength Index: FxWirePro's hourly EUR spot index is flashing at -92 levels (which is bearish), while hourly JPY spot index was at 99 (bullish) while articulating at (09:33 GMT). For more details on the index, please refer below weblink:

http://www.fxwirepro.com/currencyindex

FxWirePro launches Absolute Return Managed Program. For more details, visit:

Stock Futures Dip as Investors Await Key Payrolls Data

Stock Futures Dip as Investors Await Key Payrolls Data  U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?  Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand  Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings  Trump’s "Shock and Awe" Agenda: Executive Orders from Day One

Trump’s "Shock and Awe" Agenda: Executive Orders from Day One  2025 Market Outlook: Key January Events to Watch

2025 Market Outlook: Key January Events to Watch  Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data