The Vega-neutral vol curve flatteners for selective gamma ownership: With a few exceptions, ex-ante carry margins for gamma shorts have shrunk to wafer-thin levels as front-end implied vols have squeezed lower towards 2H’17 lows.

A glimpse through the significance of Vega: Vega is the sensitivity of an option’s value to a change in volatility. It is usually expressed as the change in premium value per 1% change in implied volatility.

Vega is generally larger in options which have a longer time until expiry, and it falls as the option approaches expiry. This is because an increase in IV is more beneficial for a longer term option than for an option that will expire in the next 10 minutes.

The Vega is at its maximum when the option is ATM and declines exponentially as the option moves ITM or OTM. This is because a small change in IV will make no difference on the likelihood of an option far out-of-the-money expiring ITM or on the likelihood of an option far into-the-money not expiring ITM. ATM options are far more sensitive since higher IV greatly increases their chances of expiring ITM.

A byproduct of lower front-end vols is steeper vol curves, especially in the 3M-6M segment of EUR-and EUR-bloc option surfaces that feature a sizeable day-weight for Italian elections in March.

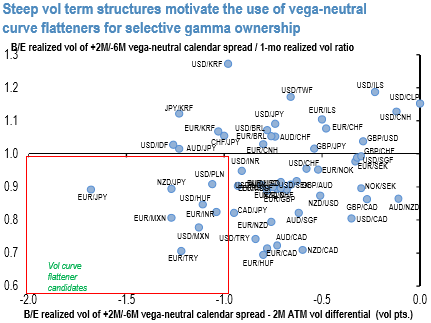

At low base vol levels and thin implied –realized vol premia, gamma ownership via vega-neutral curve flatteners has become a feasible ploy, albeit selectively; indeed the above chart demonstrates that a wide swathe of currencies have become fair game for such structures since sizeable rolldown along steep curves now subsidize a good part of the theta bill and reduce breakeven realized vols to keep gamma longs in the black.

EURTRY and USDMXN screen as the two pairs in the above chart that offer the best value in long 2M vs. short 6M vega-neutral straddle calendar format, and are straightforward to rationalize given their idiosyncratic political vol generators (NAFTA for MXN, US-Turkey visa spat for TRY).

EURJPY is another notable outlier on the chart; we are less convinced about the fundamental case of gamma ownership there, but it can act as a handy hedge against short JPY-correlation structures we have recommended recently. Courtesy: JPM

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge  Urban studies: Doing research when every city is different

Urban studies: Doing research when every city is different  U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures  Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios

Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios  Geopolitical Shocks That Could Reshape Financial Markets in 2025

Geopolitical Shocks That Could Reshape Financial Markets in 2025  US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts  U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?  European Stocks Rally on Chinese Growth and Mining Merger Speculation

European Stocks Rally on Chinese Growth and Mining Merger Speculation  BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?  US Gas Market Poised for Supercycle: Bernstein Analysts

US Gas Market Poised for Supercycle: Bernstein Analysts  2025 Market Outlook: Key January Events to Watch

2025 Market Outlook: Key January Events to Watch  Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data  Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate