BTCUSD showed a minor sell-off after Powell's testimony. He said that Fed will go for more rate hikes than anticipated. It has decreased demand for riskier assets like Crytpo. The US government has transferred 40000 Bitcoin belongings to the government to coinbase also puts pressure on crypto markets. BTC hits a low of $21858 and currently trading around $21991.

Markets eye US ADP employment change for further direction.

Factors to watch for Bitcoin price action-

US markets -

NASDAQ (positive correlation with BTC)- Bearish (negative for BTC). The index pared most of its gains on hopes of aggressive rate hikes by the Fed. Any close below 12000 will push NASDAQ prices lower to 11800/11350.

According to the CME Fed watch tool, the probability of a 50 bpbs rate hike in Mar surged to 74.9% from 24% a week ago.

Technicals-

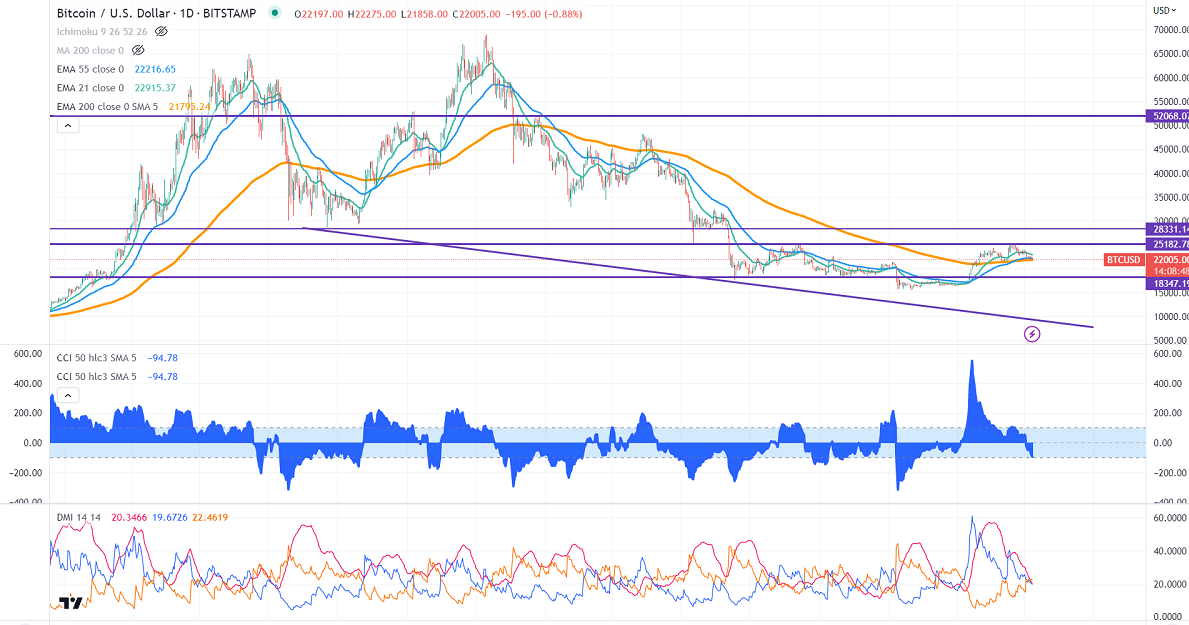

Major support- $21800. Any break below will take to the next level at $21490/$20300/19000 if possible.

Bull case-

Primary supply zone -$23000. The breach above confirms minor bullishness. A jump to the next level of $23990/$25250 is possible. Bearish invalidation only if it breaks $25300.

Secondary barrier- $25300. A close above that barrier targets $30000/$37000/$4000.

It is good to sell on rallies around $23000 with SL around $24000 for TP of $19000.

FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary