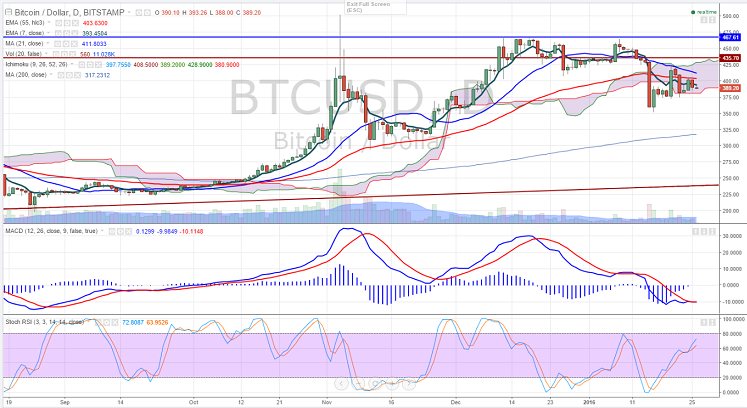

- BTC/USD has made a high of $405 yesterday and slightly declined from that level. It is currently trading around $392.

- Short term trend is bullish as long as support $370 holds.On the lower side any break below $370 will drag the pair down till $350/$315 (200 day MA).

- The pair's resistance is around $405 and break above will take the pair to next level $425/$450/$466.

- Overall bullish invalidation below $315 (200 day MA).

- Momentum indicator Stoch RSI - Buy- Buy

It is good to buy at dips around $390-395 with SL around $370 for the TP of $450/$465