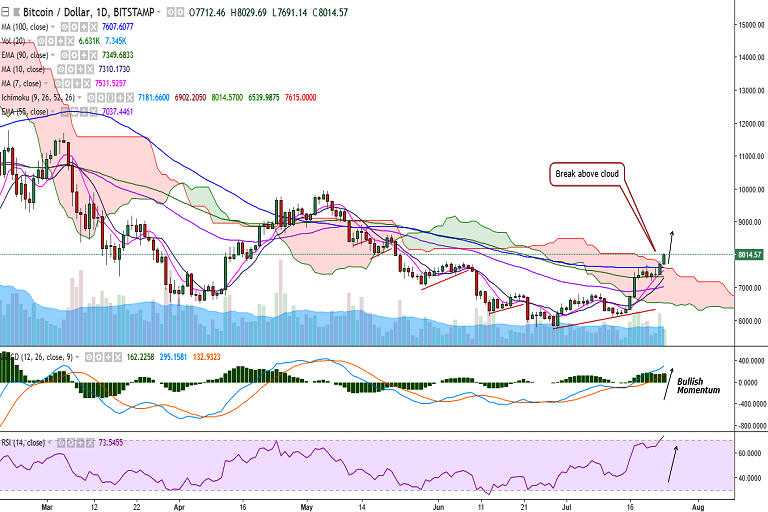

BTC/USD is continuing its uptrend on Tuesday as it broke above Ichimoku cloud. It has hit a high of 8029 levels so far in the day and is currently hovering around 8000 levels at press time (Bitstamp).

On the upside, a consistent break above 8000 levels would then target 8354 (61.8% retracement of 9948.98 and 5774.72)/8500. Further strength would see it testing 8679 (200-DMA)/9000.

On the downside, support is seen at 7615 (Cloud top) and a break below would target 7529 (7-DMA)/7308 (10-DMA). Further weakness would drag it to 7180 (78.6% retracement of 6427.16 and 9948.980/7027 (55-EMA).

Technical indicators are bullish on the daily and intraday charts.

Call Update: We recommended going long in our previous call. All the targets have been hit.

Recommendation: Book partial profits, stay long. Trail SL to 7500. TP: 8300/8500.

FxWirePro: BTC/USD reclaims 8000 handle, stay long

Tuesday, July 24, 2018 7:28 AM UTC

Editor's Picks

- Market Data

Most Popular

FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary