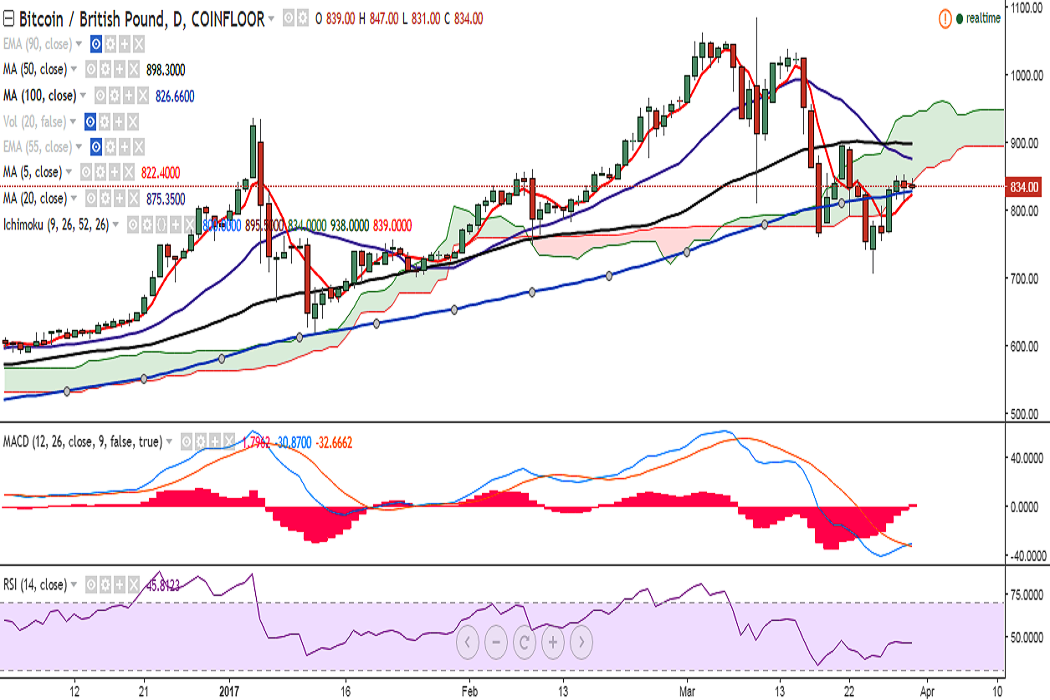

BTC/GBP is trading in a tight range from past three days with 100-DMA acting as a major support. It is currently trading at 839 levels at press time (Coinfloor).

Ichimoku analysis of daily chart:

Tenkan Sen: 800

Kijun Sen: 895.50

Intraday bias is neutral with flat-lined RSI and the pair trading in a close range. Overall bias appears bullish as long as the pair holds the 100-DMA support. Stochastics point higher and MACD appears to be on the verge of bullish crossover.

The pair is facing strong resistance at 850.78 (38.2% retracement of 1085 and 706) and a consistent break above would see it testing 875.60 (20-DMA)/898.40 (50-DMA).

On the flipside, a decisive break below 826.71 (100-DMA) would drag the pair to 810 (March 10 low)/795 (61.8% retracement of 616 and 1085)/762.15 (61.8% retracement of 706 and 853). In the weekly chart, the pair has taken strong support near 767.40 (1W 20-SMA) and only a decisive break below would confirm further downside.

FxWirePro: BTC/GBP upside capped by 38.2% fib, decisive break above targets 900

Thursday, March 30, 2017 8:59 AM UTC

Editor's Picks

- Market Data

Most Popular

FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary