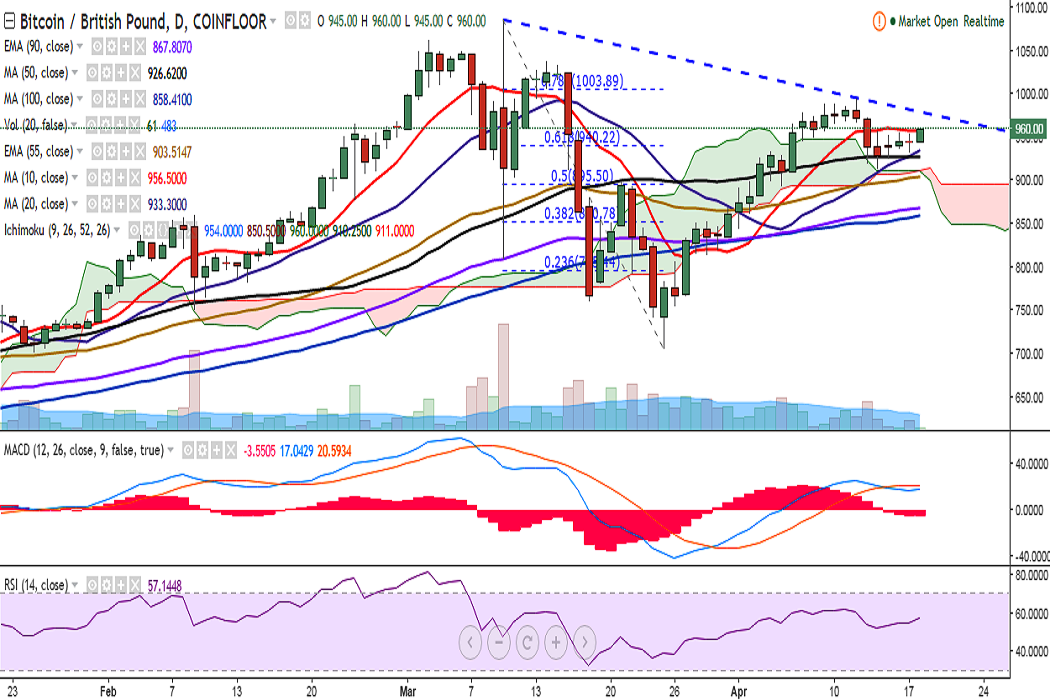

BTC/GBP broke above 10-DMA on Tuesday and is currently trading at 960 levels at press time (Coinfloor).

Ichimoku analysis of daily chart:

Tenkan Sen: 954

Kijun Sen: 850.50

On the upside, a close above 956.20 (10-DMA) would target 977 (convergence of trend line joining 1085 and 995 and 113% retracement of 936 and 616) /995 (April 12 high).

On the daily chart, Stochs and RSI are biased slightly higher and a close above 10-DMA would see further upside. On the hourly chart, the pair is currently holding above 1h 200-SMA. This, along with strong RSI, MACD, and stochs suggest bullish bias.

The pair has taken support near 926.62 (50-DMA) and any violation would drag it to 903.51 (55-EMA)/878 (February 24 low).

FxWirePro: BTC/GBP breaks above 10-DMA, good to go long on dips

Tuesday, April 18, 2017 9:37 AM UTC

Editor's Picks

- Market Data

Most Popular

FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary