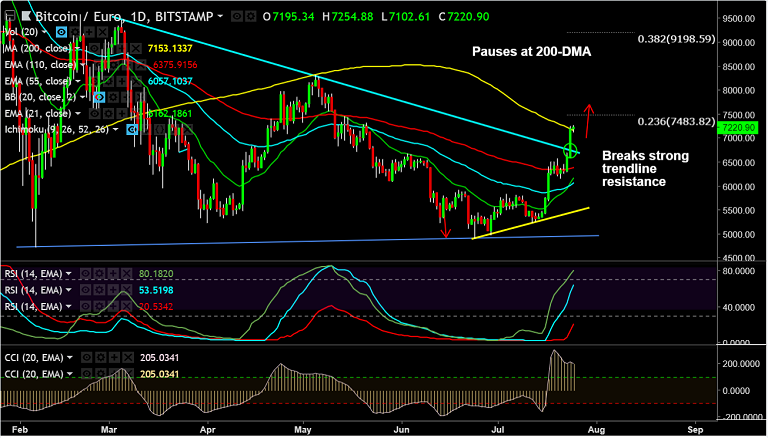

- BTC/EUR is consolidating previous session's spike, takes out 7000 mark on Tuesday's trade.

- The pair has currently paused upside at major resistance at 200-DMA at 7153, bias remains higher.

- Decisive breakout could propel the pair higher. Momentum is with the bulls.

- Stochs and RSI sharply higher. MACD supports trend and we see +ve DMI dominance.

- But caution advised as oscillators have approached overbought territory. Minor pullbacks cannot be ruled out.

- We see major weakness only on retrace below 110-EMA. Drag till 5400 then likely.

Support levels - 7153 (200-DMA), 6728 (5-DMA), 6375 (110-EMA)

Resistance levels - 6650 (trendline), 7221 (200-DMA), 7483 (23.6% Fib)

Recommendation: Good to go long on breakout at trendline, SL: 6470/ TP: 7000/ 7220/ 7480

Call update: Our previous call (https://www.econotimes.com/FxWirePro-BTC-EUR-pauses-shy-of-stiff-resistance-at-6650-break-above-targets-200-DMA-1406808) has hit TP1/2.

Recommendation: Book partial profits at highs. Trail SL to 6300, Hold for further upside on breakout at 200-DMA.

FxWirePro Currency Strength Index: FxWirePro's Hourly BTC Spot Index was at 138.417 (Bullish), while Hourly EUR Spot Index was at -138.731 (Bearish) at 0545 GMT. For more details on FxWirePro's Currency Strength Index, visit http://www.fxwirepro.com/currencyindex.

FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary