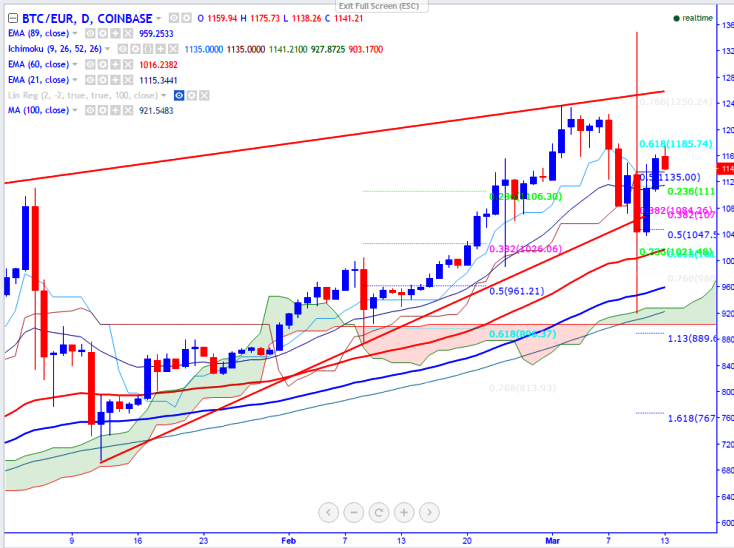

BTC/EUR has plummeted sharply till 920 after U.S Securities and Exchange Commission (SEC) rejected the idea of bitcoin ETF on Friday. The pair decline till 920 after making a high of 1350 levels (COINBASE). It is currently trading around 1155 at the time of writing.

Ichimoku analysis of daily chart indicates:

Tenkan-Sen level: 1135

Kijun-Sen level: 1135

Major reversal level -955 (89- day EMA)

Long-term trend remains to be bullish. The pair is facing resistance at 1350 and any further bullishness can be seen only above that level.

Major resistance is around 1236 (Mar 2nd high) and any break above will take the pair to next level till 1350 (Mar 10th high)/1405 (113% retracement of 1350 and 920). Short term support is seen at 1100 (21- day EMA) and any break below will drag the pair till 1047 (50% retracement of 920 and 1350)/955 (89- day EMA).

FxWirePro: BTC/EUR declines almost 30% after SEC rejects the Winklevoss ETF, good to sell on rallies

Monday, March 13, 2017 9:01 AM UTC

Editor's Picks

- Market Data

Most Popular

FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary