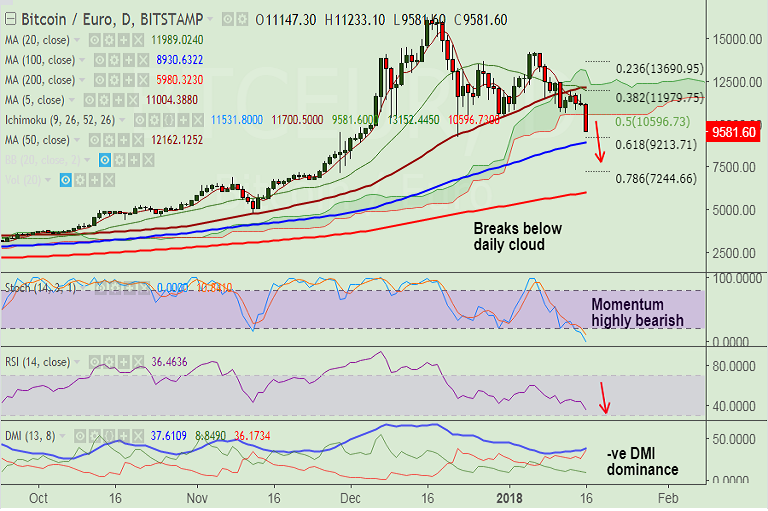

- BTC/EUR has shown a decisive break below daily Ichimoku cloud, bias lower.

- Momentum studies are bearish, Stochs are sharply lower. But are approaching oversold levels so caution advised.

- RSI weak below 50 levels and biased lower with room for further downside.

- We see -ve DMI dominance, ADX is rising which supports current downtrend.

- We see scope for test of 100-DMA at 8934 levels. Violation there could see further weakness.

- On the flipside, breakout at 20-DMA at 11989 invalidates bearish bias.

Support levels - 8929 (100-DMA), 7244 (78.6% Fib retrace of 4736 to 164557 rally), 5979 (200-DMA)

Resistance levels - 11020 (5-DMA), 12000 (20-DMA), 13670 (Dec 27 high)

Recommendation: Good to go short on rallies around 10000/10200, SL: 11000, TP: 9200/ 8900/ 7250

FxWirePro launches Absolute Return Managed Program. For more details, visit http://www.fxwirepro.com/invest