BNB Trade Idea

Key Level to Monitor: $660

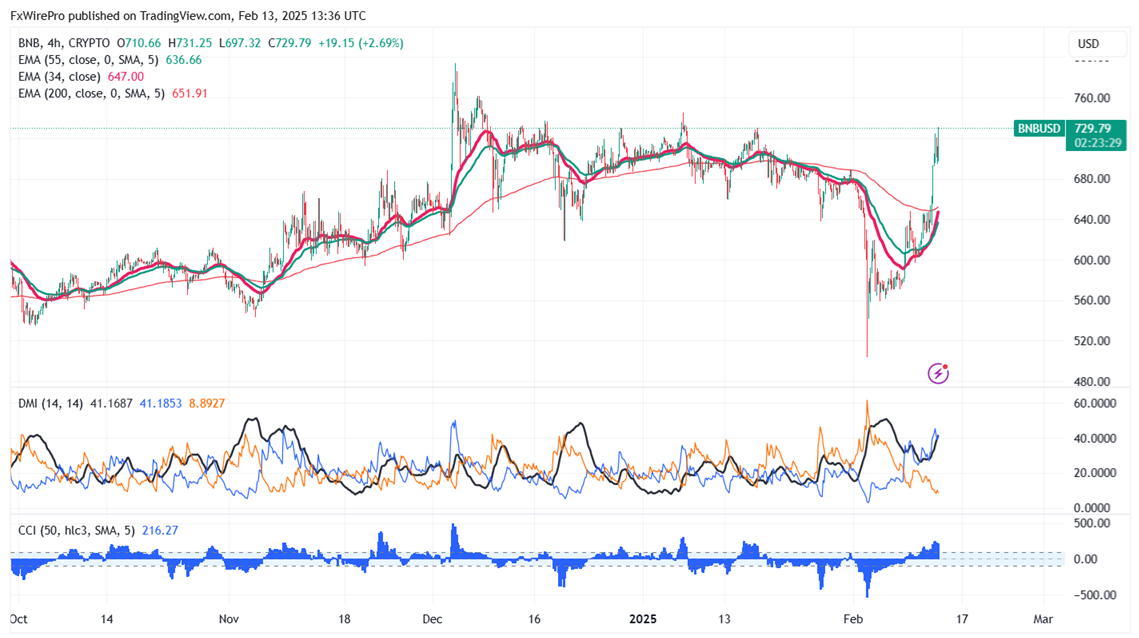

BNB/USD pair showed a minor pullback after forming a minor bottom around $596. It hit an intraday high of $645 and is currently trading around $642.

Overall bias remains bullish as long as support of $500 holds. It trades above the 34 and 55 EMA on the 4-hour chart. If the pair closes below $590, potentially leading to further declines towards $580/$550/$500.

Immediate Resistance is at $660. A successful breakout above this resistance could suggest bullish momentum, with further gains possible towards $700/$725/$775/$812/$848/$1000.

Indicators (4-Hour Chart)

- Directional Movement Index: Bullish

- CCI (50): Bullish

Trading Strategy

Consider buying on dips around $600 with a stop-loss set at $500 and a target price of $1000.

FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary