Intraday Outlook - Optimistic

Key Level to Monitor: $550

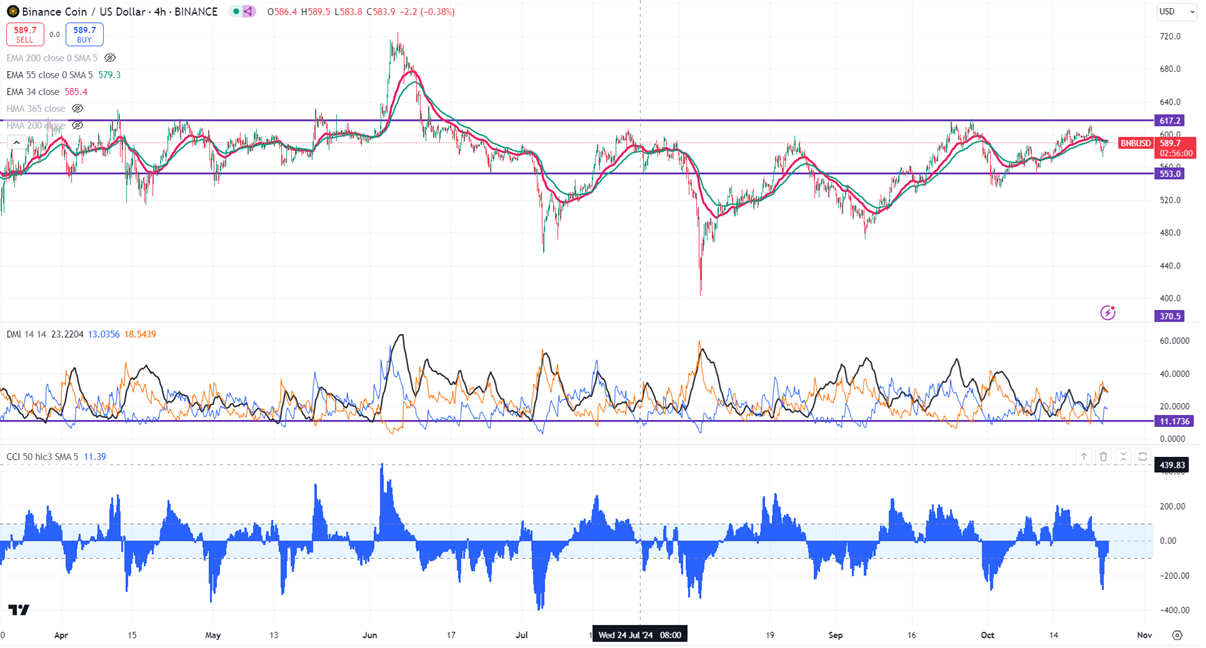

A closing price above $620 would suggest that the upward trend is likely to persist.

The BNB/USD pair took support near 55- day EMA and showed a minor pullback. Current momentum is neutral, with prices remaining above both the 34 and 55 EMA on the 4-hour chart. The pair should close above 620 for further bullishness. Conversely, a drop below $570 could indicate a bearish trend for the day. A breach of this level might lead to further declines toward $560, $550, $540, $528, $500, and potentially $470.

The immediate resistance is positioned around $620; breaking through this level may suggest some bullish momentum. Should prices exceed $620, there could be potential for further gains to $647 or even $700, with a possibility to reach $800 if it surpasses the $725 mark.

Indicators (4-hour chart)

Directional Movement Index: Bearish

CCI (50): Bearish

It may be wise to consider buying on pullbacks around $585, with a stop-loss placed at $550 and a target price of $700.

FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary