- Australian dollar is taking a hit after PBOC’s devaluation of yuan by most since June 2016.

- The PBOC raised the yuan reference rate by 605 pips to 6.7671 today - the biggest single-day jump in over two years.

- PBOC's move follows Trump's comments overnight that 'Fed' rate hikes and higher cost of borrowing would nullify the work his administration has done.

- Massive CNY devaluation indicates the world’s two biggest economies are likely moving towards a full-fledged currency war.

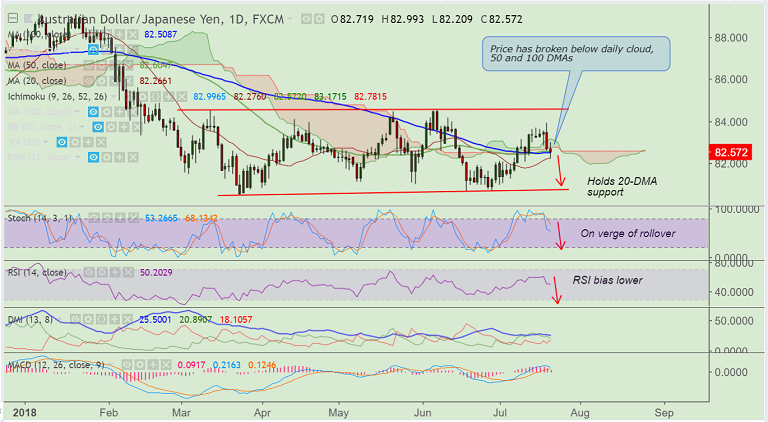

- AUD/JPY a proxy for risk is bound to see further slide. Technical indicators also are on verge of turning bearish.

- The pair is currently holding 20-DMA support at 82.26. Decisive break below will accentuate the slide.

Support levels - 82.50 (100-DMA), 82.26 (20-DMA), 80.75 (channel base)

Resistance levels - 83.11 (converged 5-DMA and 110-EMA), 83.92 (July 19 high), 84.53 (June 7 high)

Recommendation: Stay short on decisive break below 20-DMA, place stops at 83.15, target 80.75

FxWirePro Currency Strength Index: FxWirePro's Hourly AUD Spot Index was at -7.68112 (Neutral), while Hourly JPY Spot Index was at 49.1431 (Neutral) at 0345 GMT. For more details on FxWirePro's Currency Strength Index, visit http://www.fxwirepro.com/currencyindex.