- AUD/NZD is trading around 1.0470 marks.

- Pair made intraday high at 1.0477 and low at 1.0430 marks.

- Intraday bias remains slightly bullish for the moment but upside likely to be limited.

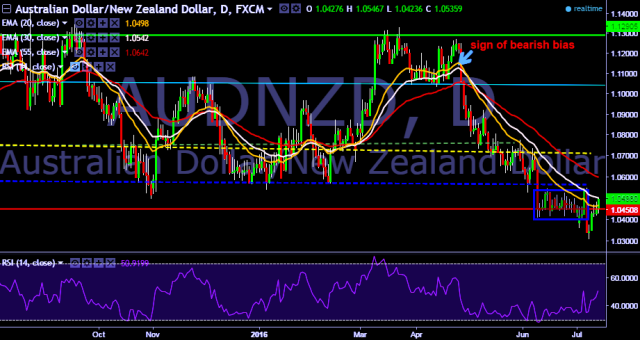

- On the top side, a sustained close above 1.0497 will drag the parity higher towards 1.0538/1.0647/1.0748/1.0823/1.0976 (January 2016 high) /1.1062 (30D EMA)/1.1123/1.1298/1.1317 levels respectively.

- Alternatively, a sustained break below 1.0420 mark will take the parity down towards key supports around 1.0315(May 05, 2015 low), 1.0261 and 1.0109 marks respectively.

- Australia’s June employment decrease to 7.9 k (forecast 10.0 k) vs previous 17.9 k.

- Australia’s June unemployment rate increase to 5.8 % (forecast 5.8 %) vs previous 5.7 %.

- Australia’s June participation rate* increase to 64.9 % (forecast 64.8 %) vs previous 64.8 %.

- Australia’s June full time employment* increase to 38.4 k vs previous 0.0 k.

- Australia’s June new motor vehicle sales m/m* increase to 3.1 % vs previous -1.1 %.

- Important to note here that in a daily chart, 20D, 30D and 55D EMA heads down and confirms the bearish trend. Current upside movement is short term trend correction only.

We prefer to take long position in AUD/NZD only above 1.0497, stop loss 1.0420 and target 1.0538/1.0647 marks.