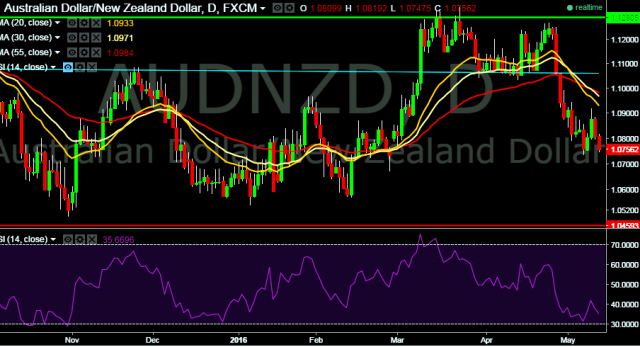

- AUD/NZD is trading around 1.0756 marks.

- Pair made intraday high at 1.0819 and low at 1.0747 marks.

- MI inflation expectation falls to fresh 8 month low to 3.2% m/m vs 3.6% previous release.

- Intraday bias remains bearish for the moment

- A daily close below 1.0754 will take the parity down towards 1.0651 and 1.0574 (February 12, 2016 low) marks.

- On the other side, a sustained close above 1.0823 will drag the parity higher towards 1.0976 (January 2016 high) /1.1062 (30D EMA)/1.1123/1.1298/1.1317 levels respectively.

We prefer to take short position in AUD/NZD only below 1.0735, stop loss 1.0823 and target 1.0651/1.0574 marks.