As anticipated, the RBA board meeting for interest rate decision, has not bring in any change, that the board has decided to hold the cash rate steady at 2.0%. With the market probability of a move near to zero, that is a sharp contrast to some months ago when markets gave a 100% probability to a rate cut by February has gone inaccurate.

Prevailing implied volatility rates for AUD/USD ATM contracts of 1M expiries is almost close to 13% while risk reversals are also highest negative flashes among G20 currency space. Thus, on a long term hedging perspective, debit gamma put spreads are advocated so as to reduce the sensitivity and focus on hedging motive.

25-delta risk of reversals of AUDUSD the most expensive pair to be hedged for downside risks as it indicates puts have been overpriced. As the risk appetite varies from different investors to different traders, we've customized our formulation of strategies for such varied circumstances.

AUD/USD is currently the best realizing dollar vol anywhere in G20 or EM, and also proved one of the better gamma buys of 2015, thanks to an outsized 12% decline in the currency. If we are correct in projecting next year's spot trough 6% below current market, AUD should once again prove its mettle as a solid vol hold due to its unique status as a high-beta currency that sits in the eye of Fed and EM/China whirlpools.

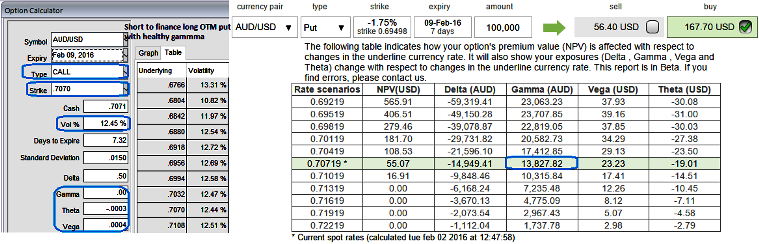

At current spot FX ticking at 0.7071, Selling 1W at the money call option is recommended to reduce the cost of hedging by financing long position in buying 1M out of the money gamma put options as the selling indications are piling up on daily and weekly graphs. So, buy 1M (-0.5%) out of the money 0.11 gamma put option and short 1W (1%) out of the money call option.

In the instance that we described above, let's suppose in 1-week time AUDUSD moves to 0.7025 - 0.7000 levels (i.e 70 pips around 1%) put instrument becomes in the money and its Delta increased from -0.5 to 0.45, Gamma is responsible for this change. Gamma controls the Delta. It is the mathematical formulae software) that decides the change in Delta based on a 1-point change in the underlying value.

FxWirePro: Aussie dollar likely to continue its bear run after RBA stands pat, AUD/USD gamma calendar combinations for hedging

Tuesday, February 2, 2016 7:27 AM UTC

Editor's Picks

- Market Data

Most Popular