Gold futures for August delivery on the Comex division of the NYME rallied to a daily peak of $1,253.50 a troy ounce, the most since last 3 weeks.

Safe-haven demand is strengthened again Fed’s stance on monetary policy, defy market expectations for rate hikes.

Yellow metal resume gaining especially after Yellen hinted dovish moves from Fed, the prices have been sensitive to moves in U.S. interest rates. The gradual path to higher rates is seen as less of a threat to gold prices than a swift series of increases.

Well, approximately about a month ago we had advocated a hedging strategy (3-Way Options Straddle versus calls), as the shorts on calls would have been a certain yields by now we now like to append existing portfolio with writing an OTM put option so as to match the trend.

For more reading on the previous strategy follow below link:

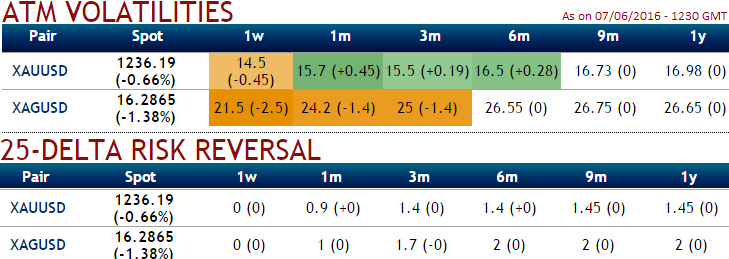

OTC Observation: The implied volatility of 1W XAU/USD ATM contracts have reduced below 15% (14.5 to be precise) and 15.7% for 1m tenors.

Although the risk reversals are still signaling upside risks in the long run, hedgers seem to be neutral in near terms ahead of Fed’s monetary policy guidance.

Well, considering above fundamental developments in bullion markets we could now foresee the juicy times in writing an OTM puts to the existing strategy.

More evidently, the precious yellow metal prices could surge further on a broadly weaker U.S. dollar and indications that the Federal Reserve was in no hurry to raise interest rates boosting the yellow metal again.

Thereby, the alteration goes this way, go long in XAU/USD 2M At the money delta put, Go long 4M at the money delta call and simultaneously, Short 2W (1%) out of the money put with positive theta.

Rationale: Bidding short term neutral risk reversals with writing 2W OTM put contracts, as stated above bullion market remains safe-haven demand which is why longer tenor calls.

Please be noted that as the cash inflows as the underlying prices keep spiking, their corresponding payoff structure has been exponential, for every rise in the spot the corresponding payoffs would be doubled.

China’s Growth Faces Structural Challenges Amid Doubts Over Data

China’s Growth Faces Structural Challenges Amid Doubts Over Data  S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays  Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes  US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts  European Stocks Rally on Chinese Growth and Mining Merger Speculation

European Stocks Rally on Chinese Growth and Mining Merger Speculation  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  Energy Sector Outlook 2025: AI's Role and Market Dynamics

Energy Sector Outlook 2025: AI's Role and Market Dynamics  Mexico's Undervalued Equity Market Offers Long-Term Investment Potential

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential  US Gas Market Poised for Supercycle: Bernstein Analysts

US Gas Market Poised for Supercycle: Bernstein Analysts  China's Refining Industry Faces Major Shakeup Amid Challenges

China's Refining Industry Faces Major Shakeup Amid Challenges  Geopolitical Shocks That Could Reshape Financial Markets in 2025

Geopolitical Shocks That Could Reshape Financial Markets in 2025  Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms  Trump’s "Shock and Awe" Agenda: Executive Orders from Day One

Trump’s "Shock and Awe" Agenda: Executive Orders from Day One  U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge  Urban studies: Doing research when every city is different

Urban studies: Doing research when every city is different  Wall Street Analysts Weigh in on Latest NFP Data

Wall Street Analysts Weigh in on Latest NFP Data  Moldova Criticizes Russia Amid Transdniestria Energy Crisis

Moldova Criticizes Russia Amid Transdniestria Energy Crisis