This week, major central banks of G7-bloc are scheduled for their respective monetary policies. Fed, ECB, BoJ, SNB, BoE are at comparatively expansionary levels who remain under pressure to expand even more with the stimulus packages to support their economic turmoil owing to the pandemic coronavirus crisis even after driving interest rates to record lows and pledging to spend trillions of dollars on asset purchases.

US-Fed and ECB are in the focus, over the past couple of months the US central bank has been a trend setter when it came to monetary policy. Not only did it react to the crisis very early on but also the extent of its expansionary measures was comparatively aggressive. That would suggest that the market would most likely expect the Fed to extend its repertoire of unconventional monetary policy measures should this become necessary (helicopter money?). And that in turn would suggest that the US dollar would initially come under considerable pressure - as was the case at the beginning of the current crisis. However, we can only hope that it will never come to that.

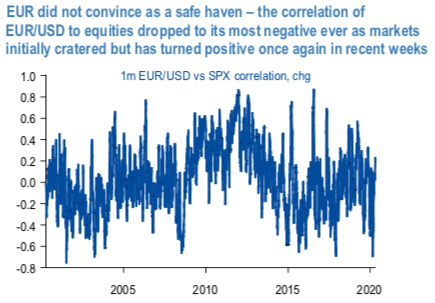

While from the onset of the COVID-19 crisis we have rejected the notion that EUR could function as an effective safe- haven for any extended period of time. The initial surge in EURUSD when equities first cracked may have been impressive – the negative co-movement between EUR and equities was the most extreme on record – but in our view this was caused by inherently temporary, one-time unwinding of a certain class of EUR-funded financial market carry trades. We maintained that once this initial round of deleveraging was exhausted EURUSD was prone to a reversal. This it has subsequently done and the correlation to equities has indeed turned positive once more (refer 1st chart). There are various reasons for this relapse in EURUSD.

Firstly, USD remains the pre-eminent international funding currency which means that deep-rooted deleveraging of, for instance, global corporate balance sheets through the duration of a recession can be expected to lift USD first and foremost (the total stock of non-resident funding in USD is $12.21tn, three times as large as the funding in EUR). Secondly, the region has attracted far larger inflows of foreign equity investments in recent years than the US (refer 2nd chart). The bull market sponsored these inflows and EUR is consequently at risk of relative equity repatriation during the current bear market.

Thirdly, EUR is susceptible to the adverse impact of the COVID-19 crash on growth and public sector debt levels as this risks reigniting debate about debt sustainability in high debt, chronically low-growth countries such as Italy.

Options Strategy And Rationale: EUR risk-reversal numbers have indicated the mounting hedging sentiments for the bearish risks amid mild fresh positive bids are observed (3rd chart).

Most importantly, the positively skewed EURUSD IVs of 3m tenors are indicating downside hedging risks (refer 4th chart).

Hence, considering these OTC bids, the below options strategies are advocated, we now wish to uphold the same strategies.

Contemplating above factors, initiated long in 2 lots of EURUSD at the money -0.49 delta put options of 3M tenors, write an (1%) out of the money put option of 2w tenors, (spot reference: 1.0880 levels). Short-legs go worthless as the underlying spot price hasn’t gone anywhere. Any slumps from here onwards are to be arrested by the 2 lots of ATM long-legs.

Those who are sceptic about mild rallies, 3m 1% in the money puts with attractive delta are advised on a hedging ground. Thereby, in the money put option with a very strong delta will move in tandem with the underlying.

Those who want to participate in the prevailing rallies that seems momentary, one can freshly initiate the strategy capitalizing these momentary rallies. The directional implementation of the same trading theme by further allow for a correlation-induced discount in the options trading also if you choose strikes appropriately. Courtesy: Sentry, JPM & Saxo

South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom

South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom  U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?  US Gas Market Poised for Supercycle: Bernstein Analysts

US Gas Market Poised for Supercycle: Bernstein Analysts  European Stocks Rally on Chinese Growth and Mining Merger Speculation

European Stocks Rally on Chinese Growth and Mining Merger Speculation  BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?  BOJ Holds Interest Rates Steady, Upgrades Growth and Inflation Outlook for Japan

BOJ Holds Interest Rates Steady, Upgrades Growth and Inflation Outlook for Japan  Trump’s "Shock and Awe" Agenda: Executive Orders from Day One

Trump’s "Shock and Awe" Agenda: Executive Orders from Day One  Bank of Canada Holds Interest Rate at 2.25% Amid Trade and Global Uncertainty

Bank of Canada Holds Interest Rate at 2.25% Amid Trade and Global Uncertainty  Bank of England Expected to Hold Interest Rates at 3.75% as Inflation Remains Elevated

Bank of England Expected to Hold Interest Rates at 3.75% as Inflation Remains Elevated  China’s Growth Faces Structural Challenges Amid Doubts Over Data

China’s Growth Faces Structural Challenges Amid Doubts Over Data