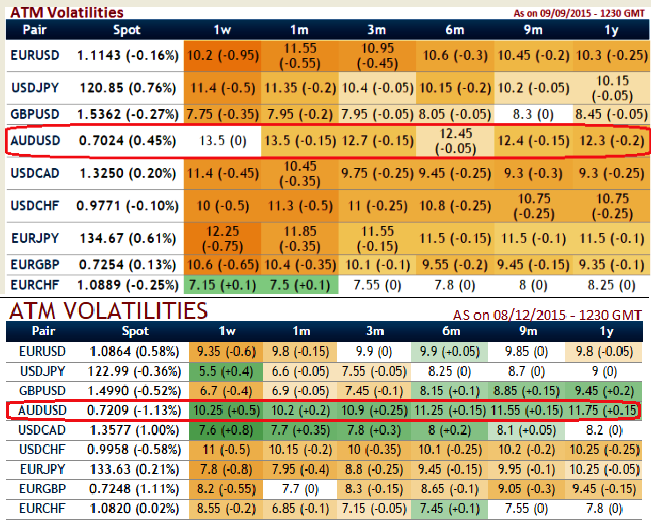

Aussie dollar has been front runner in terms of leading higher implied volatilities (see table showing IVs of ATM contracts), this pair has been consistently showing higher implied volatilities when you've to compare this with historical vols. And same is the case with the NZDUSD as well.

This lift in volatility, gamma spreads better buy into Fed Cycle, Antipodean vols lifted modestly in 2015, in tandem with our reference line projections at the beginning of the year.

Key focus for today in Asia pacific region:

RBNZ cash rate decision at 20:00 GMT - Consensus to cut 25 bps at 2.50%.

RBNZ monetary policy minutes at 20:00 GMT

Australian unemployment claims at 00:30 GMT

As per our anticipations, AUD and NZD 3M ATM vols to conclave 1.0-1.3 points this year on widespread dollar gains and the associated demand for USD calls, with a more pronounced spike in NZD compared to AUD given our more bearish directional read for the former.

This played out almost exactly to script: AUD 3M ATMs are ending the year 0.5 points higher from last year, while NZD 3M ATMs have rallied 1.3 points YTD.

We reckon the trend likely to magistrate the performance of Antipodean options from these momentous implied vol moves may mislead, grateful for high and persistent realized volatility generated by a structural drop in FX market liquidity that resulted in stellar gamma returns.

This has too little to do with idiosyncratic Antipodean developments in our view: while dovish policy surprises out of the RBNZ this year doubtless promoted higher NZD volatility.

The bulk of the returns for the complex can be explained by a common liquidity shock that is reverberating across the entire currency complex.

We look for this gamma outperformance to sustain in 1Q and 2Q when the dollar is most likely to be engulfed in the Fed storm.

FxWirePro: AUD and NZD HY vols in sync with forecasts, gamma spreads lures during Feds cycle in Q1 and Q2 of 2016

Wednesday, December 9, 2015 8:28 AM UTC

Editor's Picks

- Market Data

Most Popular