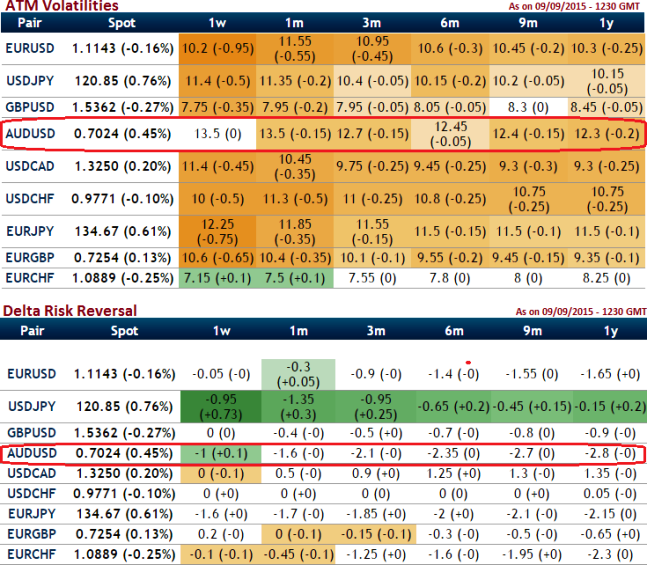

The prevailing implied volatility rates for AUD/USD ATM 1M and 1W contracts is 13.5%, while delta risk reversal for 3M to 6M contracts is exceeding -2 which means donwside sentiments are piling up. Since Aussie balance of trade has reduced to AUD -2460 million from previous -3050, while exports have marginally inched up. For Australian exporters who have their receivable exposures in AUD, we advocate buying AUDUSD at the money delta -0.49 put options.

As the risk appetite varies from different investors to different traders, we've customized our formulation of strategies for such varied circumstances.

When the above naked put option was highly sensitive to moves in the underlying exchange rate of AUD/USD when gamma was at around 0.20. We think it adds to the risk and reward profile for both holders and writers. As we all know that the Gamma is the rate of change of the Delta with respect to the movement of the rate in the underlying market.

Thus, on a hedging perspective, debit gamma put spreads are advocated so as to reduce the sensitivity and focus on hedging motive. Selling an Out-Of-The-Money put option is recommended to reduce the cost of hedging by financing long position in buying In-The-Money Puts as the selling indications are piling up on weekly graph.

So, buy 15D (1%) In-The-Money 0.15 gamma put option and short 15D (-1%) Out-Of-The-Money put option for net debit.

FxWirePro: AUD/USD’s relentless downswings and higher IV exert a pull on gamma spreads

Thursday, September 10, 2015 7:02 AM UTC

Editor's Picks

- Market Data

Most Popular

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings  Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand