We all know ATM options are more expensive than OTM options, but cheaper than ITM options. They have the highest vega which means their premium is the most sensitive to changes in the underlying market's volatility to move in either direction. As a result, increases the risk and reward for both option buyers and sellers.

Considering the below aspects on speculating perspectives, we recommend deploying one touch binary puts in our strategy in order to extract leverage on extended profitability. But do remember these are exclusively for speculative basis.

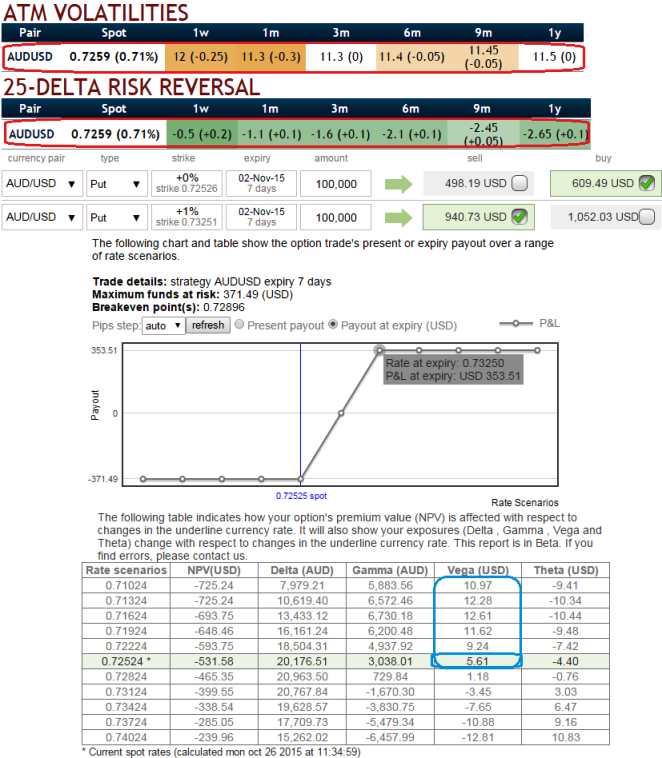

Implied volatility of AUDUSD for 1w-1y contracts is at 12%

Delta risk reversal is negative for 1w-1y contracts = -0.5 to -2.65

Last week's Chinese lackluster GDP, IP and fixed asset investment YTD numbers have added negative sentiments to Aussie foreign trades. They flashed at 6.9%, 5.7% and 10.3% respectively which are reduced from previous flashes. Aussie's very close trade exposure to china is hurting consistently.

Whereas on hedging front, by employing 2w At-The-Money vega puts one can multiply returns by twice, thrice or even pour returns exponentially and simultaneously short 1D OTM put on the contrary which gives a cushion for reducing hedging cost by receiving premium.

The prime merits of such one touch option are high yields during high volatility plays. Wider spreads indicates lack of liquidity. The spreads for one touch AUD/USD options are constant time and barrier levels.

Usually, such binary options for every change in 1 pip the relative change in option price 0.01% or even exponential at high implied volatility times. You can see that in charts how every dips would propel Vega effects.

FxWirePro: AUD/USD slumps underway - deploy vega spreads to tackle higher IV

Monday, October 26, 2015 7:59 AM UTC

Editor's Picks

- Market Data

Most Popular