- Aussie continues to drift lower after it failed to take-out 0.76 barrier in the previous session.

- AUD/USD was unable to extend gains beyond the 8-month highs at 0.7593 and had slipped lower to currently trade at 0.7492.

- The Aussie came under renewed selling pressure following the release of RBA’s monetary policy meeting minutes, which were read a tad dovish.

- Broad based sell-off across the commodities space also weighing on the resource-linked Aussie.

- Gold is down -1.30% slipping below $ 1230, copper down -0.70%, while both crude benchmarks are modestly lower by about -0.50%.

- FOMC decision due tomorrow will remain the key risk event for this week. Markets also focus on US retail sales and PPI data due later in the day.

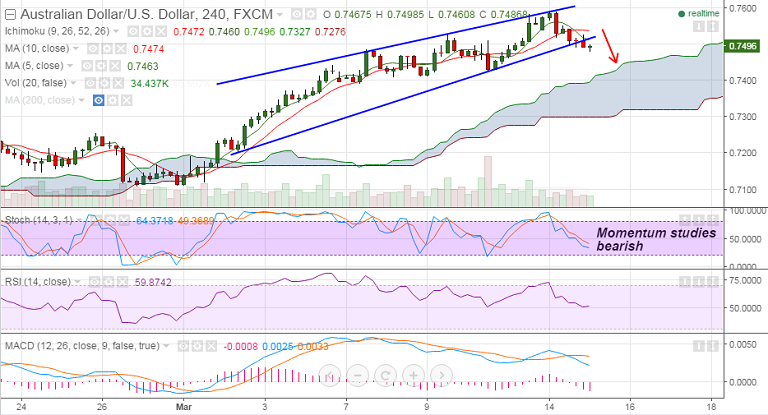

- The pair finds the immediate resistance at 0.7500 (5-DMA), while on the flip side, immediate support is located at 0.7447 (Mar 10th lows).

- Techs on 4-hourly charts are biased lower, downside could see tests of 0.7430 levels.

Recommendation: Good to sell rallies around 0.75, SL: 0.7540, TP: 0.7450/0.7430