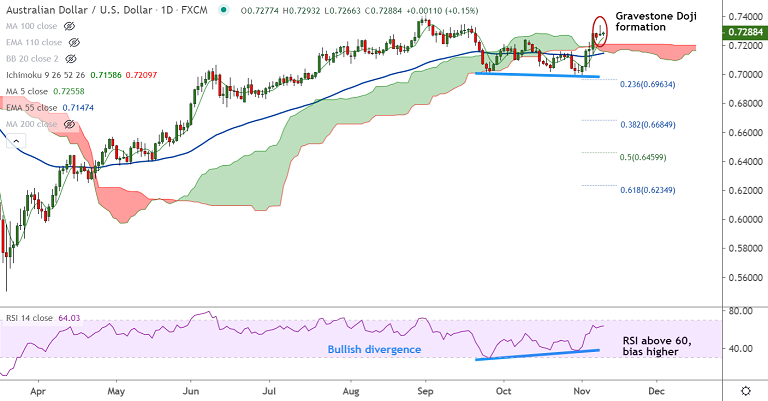

AUD/USD chart - Trading View

AUD/USD was trading 0.16% higher on the day at 0.7289 at around 09:15 GMT, bias remains bullish.

The pair has ignored a bearish 'Gravestone Doji' formation on the previous day's candle and remains buoyed amid rising risk appetite.

Pro-risk environment on the back of breakthrough in the coronavirus vaccine keep the antipodeans supported.

The investor sentiment was buoyed by reports that a coronavirus vaccine developed by Pfizer Inc. and BioNTech SE prevented over 90% of infections.

Aussie largely brushes aside below forecast China inflation data which raises doubts on the nation's economic recovery.

China Producer Price Inflation or factory-gate prices fell by 2.1% year-on-year in October versus an expected drop of 2%.

The Consumer Price Index declined by 0.3% month-no-month, missing the expectation for a 0.2% rise and bringing the annualized growth to 0.5% from September's 0.8%.

Technical analysis supports upside in the pair. GMMA indicator shows minor trend is strongly bullish.

RSI shows strength in the current uptrend. Volatility is rising and can drive the pair higher.

Price action holds above 200W MA and daily cloud. Resumption of upside will see test of 78.6% Fib at 0.7573. Bullish invalidation only below 200W MA.