The Aussie plummeted today after the mixed housing related data. AUDUSD is dropped a little at 0.7465 after the Australian Bureau of Statistics earlier reported that building approvals dropped 12.6% in October, confounding expectations for a 1.5% gain.

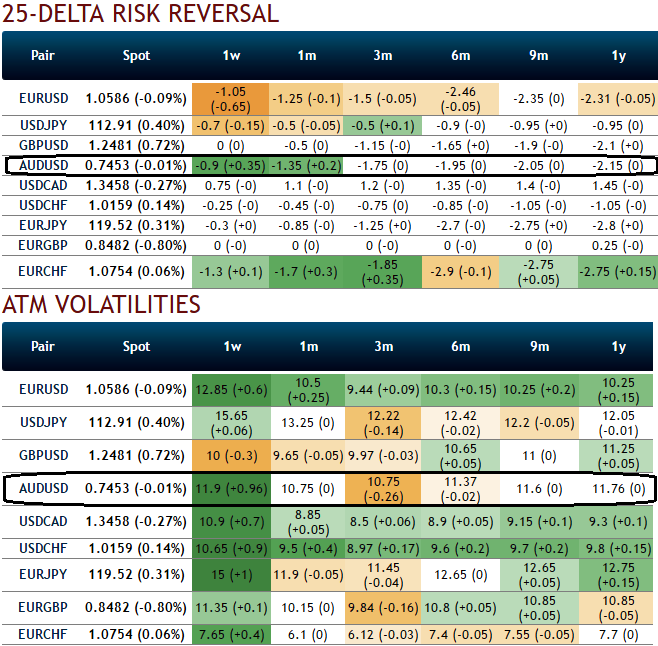

Let’s just have a glance over OTC sentiments of AUD’s ATM contracts, from positive risk reversal flashes you can possibly make out hedging functions for short term upside risks in the underlying spot FX of AUDUSD and but bearish risk sentiments in long run remains intact, while the spike in 1w IV skews also signifies the hedging interests for upside risks.

While rising negative risk reversal flashes are still signaling mounting downside risks. Considering above fundamental development that causes volatility in FX markets, we think the opportunity lies in writing an ITM put or OTM call while formulating in any speculative or hedging option strategies while capitalizing on AUDUSD's fluctuation.

Because ITM options would usually be the most expensive, thus, buyers end up paying the most and the sellers receive the most. Their premium is mostly made up of intrinsic value so they are relatively immune to Vega and Theta.

Hence, trade an ITM put option if you want to minimize the risk of Vega and Theta.

They are an excellent tool when you have a strong view on the market because deep ITM options have the highest Delta. They will behave more like a position in the underlying. But if the market moves against you, the Delta declines so the loss becomes smaller. As expiry approaches, the Delta increases.

On the flip side, OTM options would be the cheapest but they rely solely on extrinsic value and have a low Delta, Theta, and Vega. A move towards the ATM territory increases the Vega, Gamma, and Delta which boosts premium. However, Theta (time decay) also increases especially as expiry approaches. Hence, OTM shorts in calls in such scenario are most suitable for speculation.

China's Refining Industry Faces Major Shakeup Amid Challenges

China's Refining Industry Faces Major Shakeup Amid Challenges  Mexico's Undervalued Equity Market Offers Long-Term Investment Potential

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential  U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures  Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios

Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios  Wall Street Analysts Weigh in on Latest NFP Data

Wall Street Analysts Weigh in on Latest NFP Data  Moldova Criticizes Russia Amid Transdniestria Energy Crisis

Moldova Criticizes Russia Amid Transdniestria Energy Crisis  U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge  BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?  China’s Growth Faces Structural Challenges Amid Doubts Over Data

China’s Growth Faces Structural Challenges Amid Doubts Over Data  US Gas Market Poised for Supercycle: Bernstein Analysts

US Gas Market Poised for Supercycle: Bernstein Analysts