The RBA policy decision is expected to be on hold. The minutes of the April meeting singled out labor and housing markets as key areas being monitored closely. The stronger than expected jobs gains in March and new macro-prudential measures have further cemented the Bank's 'on hold' position.

China: The Apr Caixin Manufacturing PMI remained elevated at 51.2 in Mar but also indicated slower expansion relative to previous months. The Caixin index has been consistent with the NBS PMI which fell 0.6pts from near 5y peaks to 51.2 in Apr.

AUDUSD medium term perspectives: Although the pair bounces off the 0.7450, the upside area should be limited to 0.7600.

The modestly weaker than expected Australian CPI outcome has added yet another factor capping the A$: softer commodity prices; a more protectionist stance from US President Trump, and higher US yields if the Fed raises rates in June as we expect.

These leave the A$ with strong resistance at 0.76. We expect to see it heading towards 0.74 by year end.

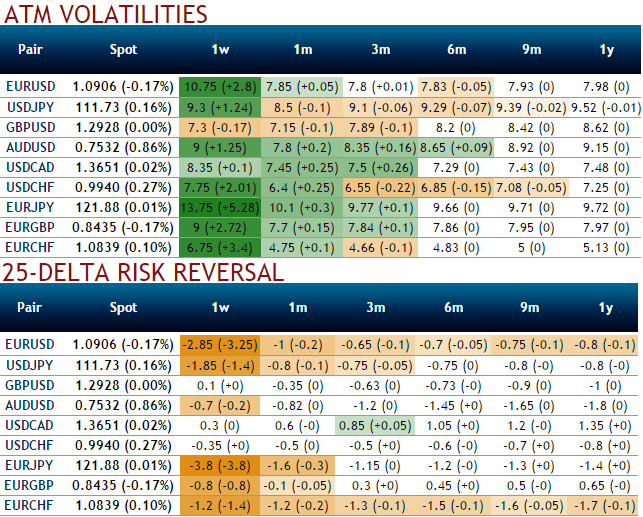

While delta risk reversal reveals divulge more interests in hedging activities for downside risks. As a result, we can understand ATM puts have been costlier where the spot FX market direction of this pair is heading towards 0.74-75 or below technical levels. So, the speculators and hedgers for bearish risks are advised to optimally utilize the upswings and bid on 1-3m risks reversals that would encompass Fed’s June meeting.

AUDUSD's higher IV with negative delta risk reversal can be interpreted as an opportunity for put longs as the market reckons the price has downside potential for large movement in the days to come which is resulting option holders’ on competitive advantage.

Urban studies: Doing research when every city is different

Urban studies: Doing research when every city is different  Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data  BOJ Holds Interest Rates Steady, Upgrades Growth and Inflation Outlook for Japan

BOJ Holds Interest Rates Steady, Upgrades Growth and Inflation Outlook for Japan  Federal Reserve Faces Subpoena Delay Amid Investigation Into Chair Jerome Powell

Federal Reserve Faces Subpoena Delay Amid Investigation Into Chair Jerome Powell  Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes  European Stocks Rally on Chinese Growth and Mining Merger Speculation

European Stocks Rally on Chinese Growth and Mining Merger Speculation  RBA Expected to Raise Interest Rates by 25 Basis Points in February, ANZ Forecast Says

RBA Expected to Raise Interest Rates by 25 Basis Points in February, ANZ Forecast Says  Mexico's Undervalued Equity Market Offers Long-Term Investment Potential

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential  Trump’s "Shock and Awe" Agenda: Executive Orders from Day One

Trump’s "Shock and Awe" Agenda: Executive Orders from Day One  Geopolitical Shocks That Could Reshape Financial Markets in 2025

Geopolitical Shocks That Could Reshape Financial Markets in 2025  Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate