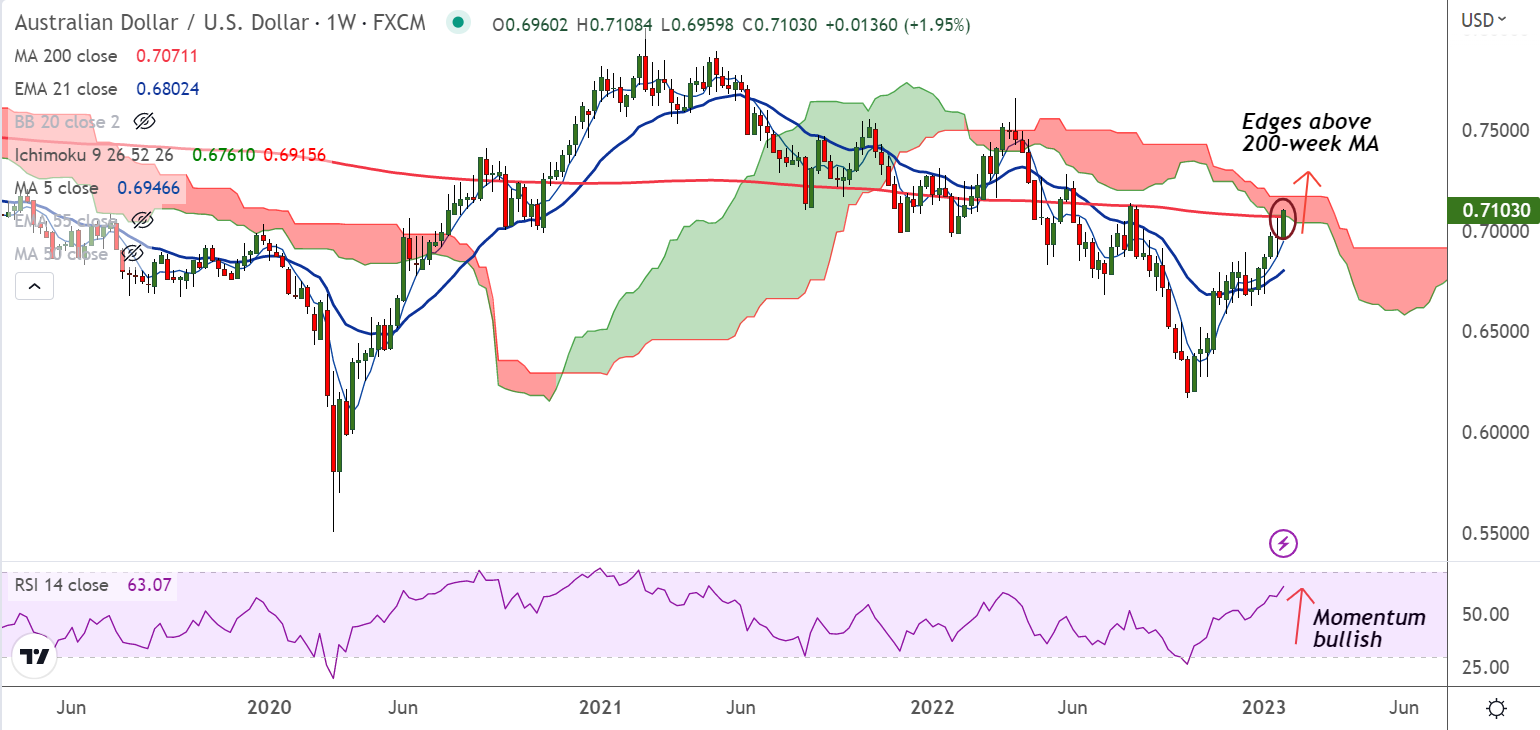

Chart - Courtesy Trading View

AUD/USD was trading 0.81% higher on the day at 0.7101 at around 04:20 GMT, outlook bullish.

Aussie buoyed after Australia CPI inflation rises more than expected in Q4, stoking expectations of hawkish RBA.

Data from the Australian Bureau of Statistics (ABS) earlier on Wednesday showed CPI inflation grew 1.9% in the three months to December, beating forecasts at 1.6%, as well as the prior quarter’s reading of 1.8%.

On an annualized basis, CPI inflation was up 7.8%, more than estimates for a rise of 7.5% and the prior quarter’s reading of 7.3%.

Upbeat inflation data adds more pressure on the Reserve Bank of Australia (RBA) to keep raising interest rates.

It is to be noted that Australia's inflation has remained hot even after the central bank hiked rates by a cumulative 300 basis points (bps) in 2022, from a record low of 0.1%.

Markets now expect the RBA to hike its Official Cash Rate (OCR) by 25 basis points (bps) in February and June policy meetings.

AUD/USD hit a 5-month high of 0.7108, edged above major resistance at 200-week MA. A decisive close above 200-week MA will fuel further gains in the pair.