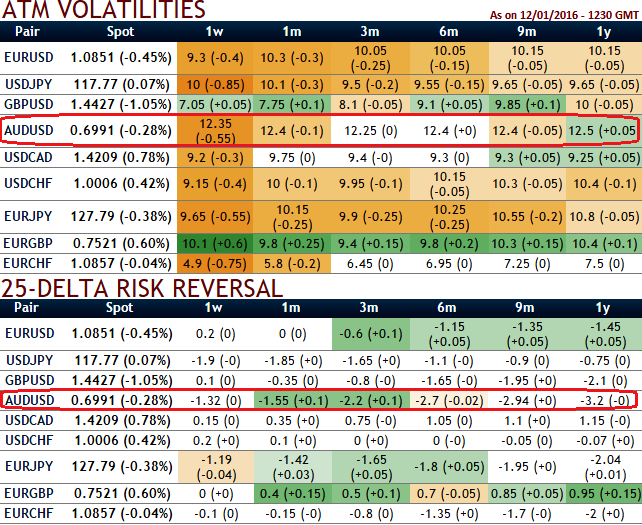

From the nutshell, one can make out AUD/USD is the pair to perceive highest IVs with most expensive puts for hedging downside risks.

25- Delta risk reversal attributes the premiums of AUDUSD puts and calls on the most liquid OTM contracts due the difference vols, which in turn divulge the relative costliness of the downside protection for the underlying spot FX, so we can anticipate next underlying market downward direction with help of these negative numbers.

Options are commonly used by private investors and businesses to hedge open or future deals. The latter is useful for companies who have overseas invoices to pay or profits to receive in a foreign currency.

Insuring an open forex payable exposure on imports

If you have an open deal and you want to lock-in the profit or limit the loss, but don't want to close your trade, you could hedge it with an option. The effect of an option hedge is to keep the profit potential open, yet limit (hedge) any loss.

AUDUSD has dropped from the high of 0.7327 up to 0.6926 and still have more downside potential as per the OTC market sentiments, with the current levels of 0.7033 one can build hedging strategy as explained below contemplating above IVs and risk reversal computations.

Mitigate downside risks of AUDUSD with PRBS:

We now capitalize upon higher IVS and any upswings in abrupt can be utilized by employing 2 lots of 1.5% ITM shorts in puts with shorter expiries.

We stated to maintain the same strategy for hedgers by using these small bounces from then to help our ITM shorts, this would have certainly ensured returns in the form of premiums.

Having said that, stay firm with any existing longs on at the money -0.50 delta puts as it would begin functioning effectively from recent past. Add one more long on 1% out of the money put in order to give leveraging effects to the portfolio with lesser cost of trade since we prefer OTM instrument.

Hence, as shown in the diagram the strategy is constructed in the ratio of 3:2 for net credit with net delta at -0.50.

FxWirePro: AUD/USD higher IVs and risk reversals keep import exposures hedged with 3:2 backspreads

Wednesday, January 13, 2016 8:15 AM UTC

Editor's Picks

- Market Data

Most Popular