AUD/USD strongly rebounded erasing earlier losses on Friday as strong rebound in oil prices and slight weakness in US dollar supported Aussie bulls.

- Much of the rebound was due to global oil prices gaining as much as 12 percent .

- However, further upside is expected to be limited as the pair finds strong resistance at 0.7100 which should limit upside and bring a decline towards lower levels.

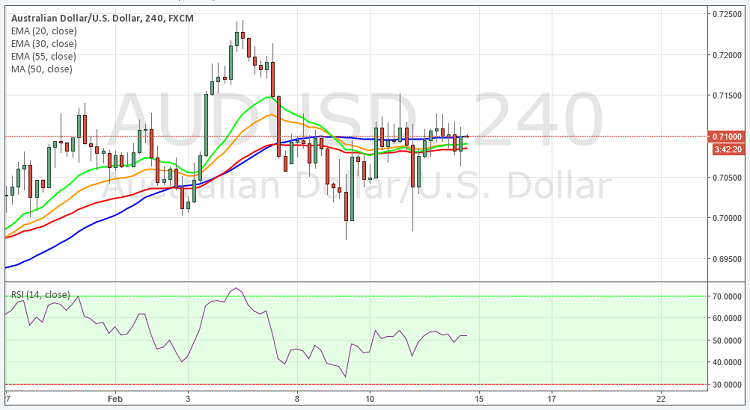

- Technically in the 4 hours chart, the pair finds strong resistance at 50-day moving average, whilst the RSI heading south at 47.

- To the upside, the strong resistance can be seen at 0.7176, a break above this level would take the pair towards next resistance level at 0.7242.

- To the downside immediate support can be seen at 0.7043, a break below this level will open the door towards next level at 0.7000.

Recommendation: Go short around 0.7125, targets 0.7040, 0.6970, SL 0.7200

Resistance Levels

R1: 0.7108 (50% Retracement level)

R2: 0.7176 (61.8% Retracement level)

R3: 0.7242 (Feb 4th high)

Support Levels

S1: 0.7043 (38.2% Retracement level)

S2: 0.7000 (Psychological levels)

S3: 0.6960 (Feb 3rd high)