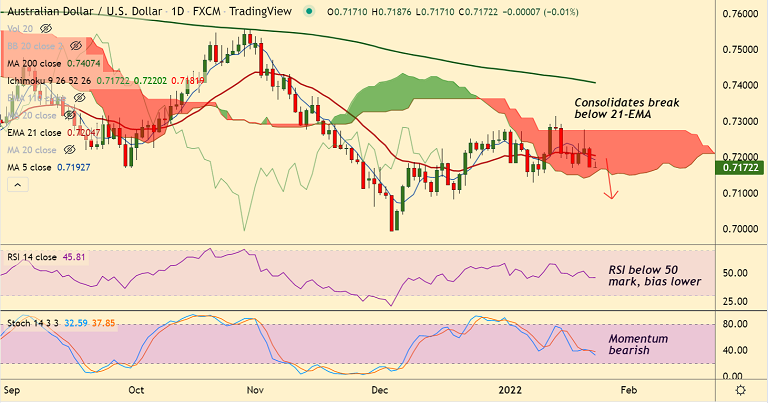

Chart - Courtesy Trading View

Spot Analysis:

AUD/USD was trading 0.12% lower on the day at 0.7164 at around 08:15 GMT.

Previous Week's High/ Low: 0.7276/ 0.7169

Previous Session's High/ Low: 0.7228/ 0.7171

Fundamental Overview:

Data released earlier today showed preliminary readings of January CBA Manufacturing PMI eased to 55.3, below 55.9 forecast and 57.4 revised down prior readings.

The Services PMI slumped into contraction territory with 45 figure compared to 51.8 expected and 55.1 prior.

Australia’s daily covid infections ease for the fifth consecutive day. Rising geopolitical fears keep pressure.

Focus now on Tuesday’s Australia Consumer Price Index (CPI) for Q4, expected 1.0% versus 0.8% QoQ prior, for fresh impulse.

FOMC policy meeting will take precedence on Wednesday.

Technical Analysis:

- AUD/USD is set to extend break below 21-EMA and trendline support

- Momentum studies are strongly bearish, Stochs and RSI are sharply lower

- GMMA indicator shows major and minor trend are bearish

- Volatility is rising, MACD supports further downside

Major Support and Resistance Levels:

Support - 0.7165 (200-week MA), Resistance - 0.7191 (5-DMA)

Summary: AUD/USD finds strong support at 200-week MA and daily cloud base. Watch out for breach below for further weakness.