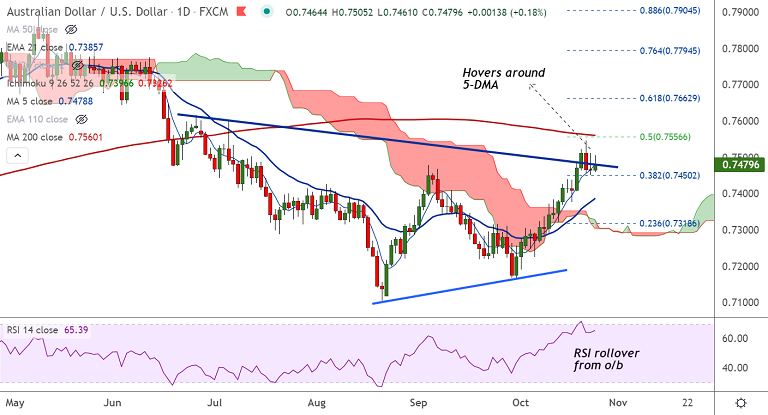

AUD/USD chart - Trading View

AUD/USD was trading 0.36% higher on the day at 0.7514 at around 05:10 GMT, extends previous session's 0.28% gains. Price action has breached major trendline resistance and is on track to test 200-DMA at 0.7559.

Surging iron-ore prices, firmer Chinese yuan and risk-on market sentiment amid ongoing US-Sino talks are underpinning the Australian dollar. Focus now on Australian CPI report due Wednesday for further impetus.

Technical Analysis:

GMMA Indicator - Bullish

Ichimoku Analysis - Bullish

Oscillators - Overbought, but no signs of reversal

Bollinger Bands - High volatility

Major Support Levels: 0.7487 (5-DMA), 0.7450 (38.2% Fib), 0.7414 (110-EMA)

Major Resistance Levels: 0.7559 (200-DMA), 0.76, 0.7662 (61.8% Fib)

Summary: AUD/USD trades with a bullish bias. Scope for test of 200-DMA at 0.7559.