- Bullish momentum in AUD/USD ran out of steam after ratings agencies fired warning shots about Australia’s fiscal health.

- Aussie fails to benefit from resilience in iron ore and falling political uncertainty in Australia.

- Iron ore prices remain steady as well in Asia above $55/tonne, while PM Turnbull declared victorious in election results.

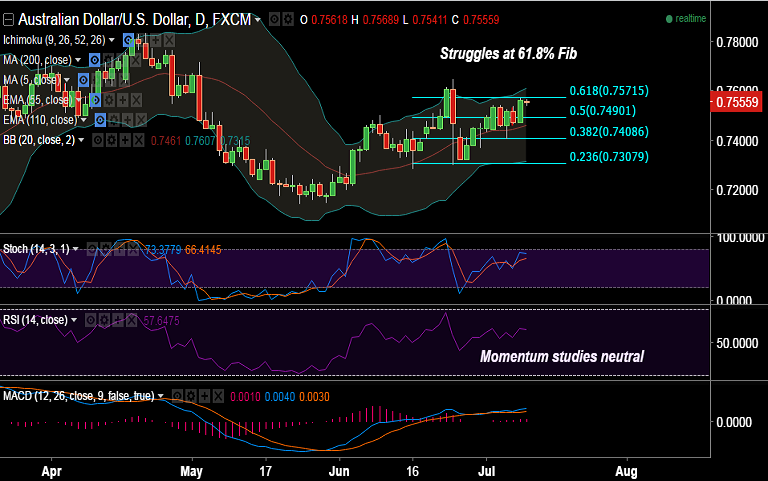

- The pair is trimming Friday’s gains, upside seems to be capped at 61.8% Fib of 0.7835 to 0.7145 fall.

- Technically the pair is poised for further gains, breakout above 61.8% Fib to see upside resume.

- Support on the downside is seen at 0.7516 (5-DMA), 0.75 and then 0.7490 (10-DMA).

- Resistance is seen at 0.7572 (61.8% Fib of 0.7835 to 0.7145 fall), 0.7580 (Apr 8 high) and 0.7720.

Recommendation: Good to long breakout above 0.7572, SL: 0.7515, TP: 0.76/ 0.7650/ 0.77