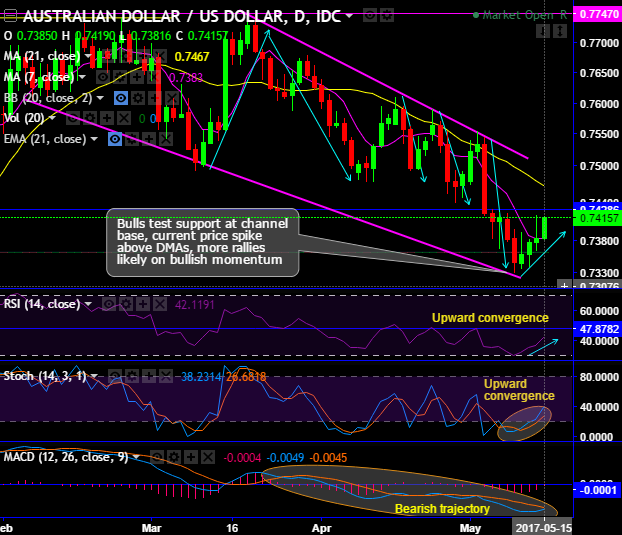

AUDUSD bulls test after channel base, current price spike above DMAs, more rallies likely on bullish momentum indicated by both leading oscillators.

On the flip side, amid the bullish swings, bears have managed to pull back prices below 21DMAs on weekly terms.

“Triple top formation” has occurred on this timeframe to evidence more slumps (refer weekly chart).

While the consolidation phase in major downtrend has now been drifting in the sloping channel again, as the current prices are slipping below channel resistance and 7EMAs (refer monthly charts).

The prices dropped after consistently restrained at 0.7761 (consolidation phase has gone in range bounded trend, refer rectangular shaped area) & been breaking major supports at 0.7439, the current price has again slid below EMAs. Momentum indicators (in monthly terms) have been turned into bearish bias to indicate losing strength in the previous uptrend and stochastic signals intensified bearish momentum.

But for the day, upswings are favored by healthy bullish momentum both RSI and stochastic curves, are converging upwards. MACD on this timeframe has been indecisive remaining in bearish trajectory to signals prolonged downtrend further.

Hence, contemplating above daily bullish sentiment, on trading perspective, it is advisable to buy one touch binary calls at spot reference: 0.7415. The intraday speculators can eye on targets about 20-30 pips where we could see next stiff resistance at 0.7435 levels. The strategy is likely to fetch leveraged yields as long as underlying spot FX keeps spiking towards the above-mentioned strike on or before the binary expiry duration.

On the flip side, stay short in forward exchange contracts off mid-month tenors on hedging grounds as more slumps are on the cards in the weeks to come.