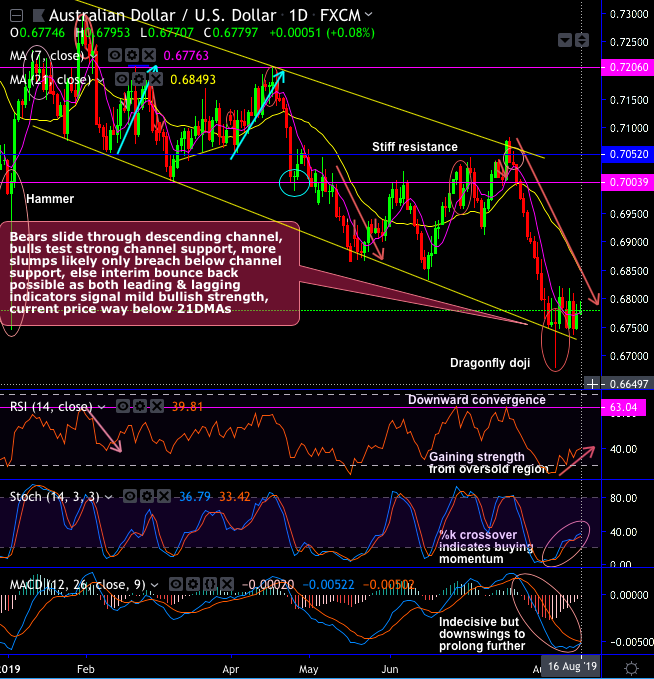

Technical chart and candlestick patterns: AUDUSD has been sliding through the sloping channel in the minor trend (refer daily chart). The pair has taken channel support and hovering at 7DMAs to bring in interim upswings but exhausted at 0.6820 levels.

More slumps likely only breach below the channel support, otherwise, the interim bounce back possible though the current price way below 21DMAs as both leading and lagging indicators signal mild bullish strength.

On a broader perspective, the major trend of this pair has been extending double top formation with a breach below the neckline and may head towards 10-year lows at 0.6675 areas (refer monthly plotting), bearish engulfing candles followed by shooting star patterns plummet prices well below 7EMA again on this timeframe. Every attempt of upswings is restrained below 21-EMA levels.

Both RSI and stochastic curves have signaled selling momentum as these leading oscillators show downward convergence to the prevailing price slumps.

While bearish MACD and EMA crossovers substantiate the bearish sentiments and indicate downtrend to prolong further.

Trade tips:On trading perspective, at spot reference: 0.6782 levels, contemplating above technical rationale, it is advisable to execute tunnel spread options strategy with upper strikes at 0.6820 and lower short lower strikes at 0.6735 levels, thereby, one can achieve certain yields as long as the underlying spot FX keeps dipping but remains well above lower strikes on the expiration.

Alternatively, on hedging grounds ahead of RBA’s monetary policy minutes next week, we advocate shorting futures contracts of mid-month tenors as the underlying spot FX likely to target southwards below 0.66 levels in the medium run. Writers in a futures contract are expected to maintain margins in order to open and maintain a short futures position.