We expect AUDUSD to decline through 2017 on skinnier rate differentials and a pull-back in commodity prices.

The Dec-17 target is 0.68, 10% below forwards. The combination of a more high conviction Fed cycle in 2017 and further RBA easing should see policy rate cross-over occur for the first time since the late 1990s.

This will leave minimal carry support for AUD, which is particularly important given its vulnerability to a turn in China’s momentum or adverse developments in global trade.

Bearish: AUD/USD below 0.73 if:

1) The labor market weakens forcing the RBA to respond more aggressively to weak inflation;

2) The Fed responds to animal spirits and bullish survey data by delivering a faster pace of hikes than currently expected;

3) Trade tensions and capital outflows force genuine CNY devaluation.

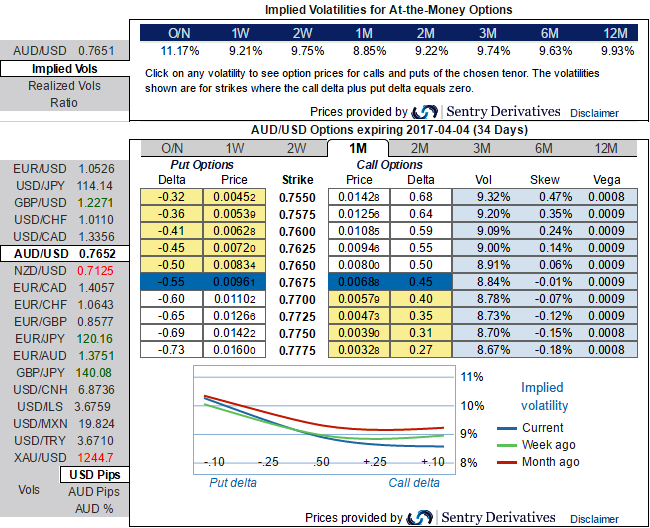

Accordingly, OTC hedging indications from the diagrams evidencing risk reversals and IV skews are in tandem with the above mentioned forecasts and its rationale.

Please be informed that the nutshell showing risk reversals are bids for the hedging for the downside risks, as a result, puts are on more demands over calls. The negative risk reversals across all tenors are indicating the bearish hedging interests.

Let’s also glance on sensitivity tool for 1-3m IV skews would signify the interests of OTM put strikes that would imply hedging sentiments are for downside risks in the underlying spot FX.

China's Refining Industry Faces Major Shakeup Amid Challenges

China's Refining Industry Faces Major Shakeup Amid Challenges  Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes  UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  BOJ Rate Decision in Focus as Yen Weakness and Inflation Shape Market Outlook

BOJ Rate Decision in Focus as Yen Weakness and Inflation Shape Market Outlook  RBA Raises Interest Rates by 25 Basis Points as Inflation Pressures Persist

RBA Raises Interest Rates by 25 Basis Points as Inflation Pressures Persist  Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target

Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target  2025 Market Outlook: Key January Events to Watch

2025 Market Outlook: Key January Events to Watch