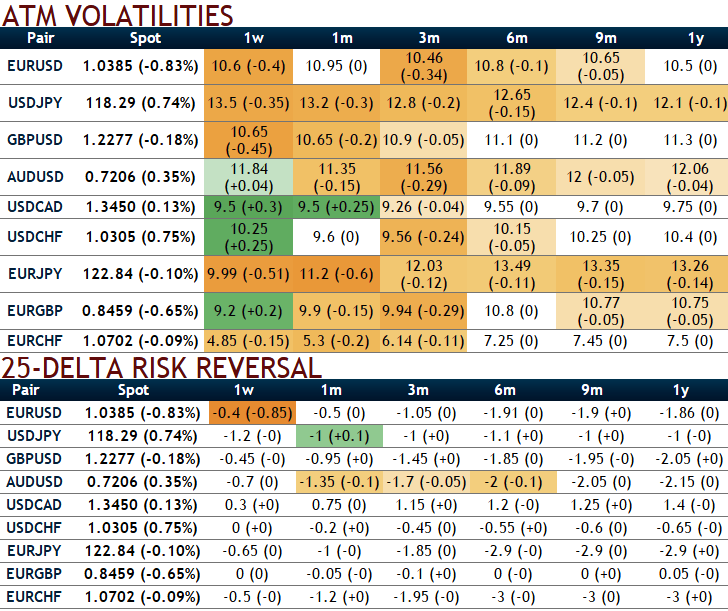

Please note that AUDUSD OTC functions have been intensified ahead of data announcements in this week, you could observe that 1w IVs are bolstered as Fed’s minutes, US unemployment claims, Non-manufacturing PMIs, Aussie and US trade balances are the major data focuses that could stimulate volatilities in both AUDUSD spot and derivatives markets.

Medium-term outlook: This APAC pair is likely to remain well below 0.7305 levels. More slumps are on the cards below 0.71 levels amid minor spikes. The US dollar has had an impressive rise since the US election and has a potential to rise further during the months ahead. The Fed’s assertive tightening projections plus US fiscal expansion should maintain upside pressure on US interest rates and the US dollar.

Against that coal and iron ore are likely to sustain a good portion of their dramatic rises, and economic data should improve in Q4 and Q1, but these forces are subservient to the US dollar’s trend. There’s also the issue of Australia’s AAA rating, seen at risk.

While delta risk reversal reveals divulge more interests in hedging activities for downside risks. As a result, we can understand ATM puts have been costlier where the spot FX market direction of this pair is heading towards 0.71 or below technical levels. So, the speculators and hedgers for bearish risks are advised to optimally utilize the upswings and bid on 1-3m risks reversals.

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge  Bank of America Posts Strong Q4 2024 Results, Shares Rise

Bank of America Posts Strong Q4 2024 Results, Shares Rise  European Stocks Rally on Chinese Growth and Mining Merger Speculation

European Stocks Rally on Chinese Growth and Mining Merger Speculation  Stock Futures Dip as Investors Await Key Payrolls Data

Stock Futures Dip as Investors Await Key Payrolls Data  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  Trump’s "Shock and Awe" Agenda: Executive Orders from Day One

Trump’s "Shock and Awe" Agenda: Executive Orders from Day One  Energy Sector Outlook 2025: AI's Role and Market Dynamics

Energy Sector Outlook 2025: AI's Role and Market Dynamics  Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms  UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data  US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts  U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures