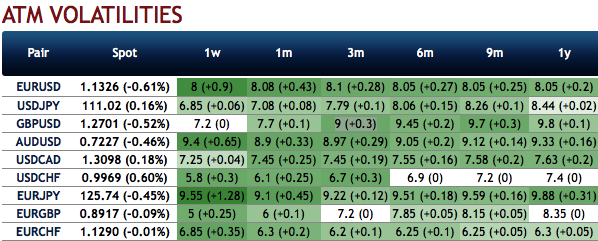

Please be noted 3m IVs of AUDUSD flash highest numbers among G10 space with mounting hedging sentiments for bearish risks.

We have advocated delta longs for long term on hedging grounds, more number of longs comprising of ITM instruments and capitalizing on prevailing rallies, theta shorts in short-term to optimize the strategy (as shown below).

The execution of hedging strategy: Short 1m (1%) OTM put option with positive theta (position seems good even if the underlying spot goes either sideways or spikes mildly), simultaneously, add long in 2 lots of delta long in 3m (2%) ITM -0.79 delta put options. A move towards the ATM territory increases the Vega, Gamma and Delta which boosts premium.

Since the trend of this pair has been drifting in range as you can see the rectangular area on daily plotting of above technical charts and such price behaviour has been prolonged from last 4-6 weeks, theta shorts in OTM put option have gone worthless and the premiums received from this leg is sure profit.

Most importantly, please be noted that the positively skewed IVs of 2m tenors signify the hedgers’ interests to bid OTM put strikes upto 0.7150 levels (above nutshell). While bearish delta risk reversal also substantiates that the hedging activities for the downside risks remain intact.

Accordingly, we would like to uphold the same option strategy as stated above on hedging grounds.

Thereby, deep in the money put option with a very strong delta will move in tandem with the underlying.

Both the speculators and hedgers for bearish risks are advised to capitalize on the prevailing price dips and bid 2m risks reversals to optimally utilize delta long put options with a view of arresting bearish risks.

Currency Strength Index: FxWirePro's hourly AUD spot index is inching towards -77 levels (which is bearish), while hourly USD spot index was at 49 (bullish) while articulating (at 08:02 GMT). For more details on the index, please refer below weblink:

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  Mexico's Undervalued Equity Market Offers Long-Term Investment Potential

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential  Wall Street Analysts Weigh in on Latest NFP Data

Wall Street Analysts Weigh in on Latest NFP Data  Moldova Criticizes Russia Amid Transdniestria Energy Crisis

Moldova Criticizes Russia Amid Transdniestria Energy Crisis  US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts  Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings  Energy Sector Outlook 2025: AI's Role and Market Dynamics

Energy Sector Outlook 2025: AI's Role and Market Dynamics  JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand  China’s Growth Faces Structural Challenges Amid Doubts Over Data

China’s Growth Faces Structural Challenges Amid Doubts Over Data  Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close