As anticipated the RBA monetary policy decision has been on hold to keep cash rates at 1.50%.

AUDUSD medium term perspectives: We stated in our previous write up that even though the pair bounces off the 0.7450, the upside area should be limited to 0.7600 (refer below weblink where we had explicitly specified that the pair should test its stiff resistance at 0.76 levels) http://www.econotimes.com/FxWirePro-AUD-USD-macros-forecasts-and-OTC-indications-673840

Well, for now, the resilience of US equity markets to the distractions of the Trump administration is a positive backdrop for risk-sensitive AUD. Chinese markets are of course less helpful as the deleveraging push continues, but the uptrend in steel prices suggests the potential for recovery in iron ore prices. The rebound in Australian job creation keeps RBA rate cut talk at bay.

Our RBA outlook (on hold for some time) is anchoring front end valuations. We expect 3yr swap rates to remain in a 1.8% to 2.3% range, with core inflation still below 2%. But multi-month, we expect the ongoing rise in US interest rates to chip away at AUDUSD, leaving it around 0.73 by Q3.

These leave the A$ with strong resistance at 0.76. We expect to see it heading towards 0.74 by year end.

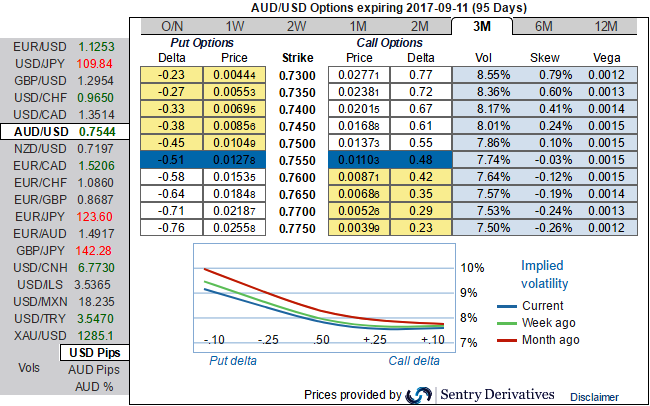

Please be noted that the positively skewed IVs of 3m tenors signify the hedgers’ interests to bid OTM strikes upto 0.73 (please refer above diagram)

While delta risk reversal reveals divulge more interests in hedging activities for downside risks even though we see the positive shift in hedging arrangements. As a result, we can understand ATM puts have been costlier where the spot FX market direction of this pair is heading towards 0.74-75 or below technical levels. So, the speculators and hedgers for bearish risks are advised to optimally utilize the upswings and bid on 1-3m risks reversals that would encompass Fed’s June meeting.

AUDUSD's higher IV with negative delta risk reversal can be interpreted as the opportunity for put longs as the market reckons the price has downside potential for large movement in the days to come which is resulting option holders’ on competitive advantage.

Hence, we advocate weighing up above aspects in below option strategy, we eye on loading up with fresh vega longs for long-term hedging, more number of longs comprising of ATM instruments and ITM shorts in short term would optimize the strategy.

So, the execution of hedging positions goes this way:

Short 2w (1%) OTM put option as the underlying spot likely to spike mildly, simultaneously, go long in 1 lot of vega long in 1m ATM -0.49 delta put options and 1 lot of (1%) ITM -0.55 delta put of 2m expiry.

China’s Growth Faces Structural Challenges Amid Doubts Over Data

China’s Growth Faces Structural Challenges Amid Doubts Over Data  Geopolitical Shocks That Could Reshape Financial Markets in 2025

Geopolitical Shocks That Could Reshape Financial Markets in 2025  U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures  Wall Street Analysts Weigh in on Latest NFP Data

Wall Street Analysts Weigh in on Latest NFP Data  US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts  Stock Futures Dip as Investors Await Key Payrolls Data

Stock Futures Dip as Investors Await Key Payrolls Data  S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays  Energy Sector Outlook 2025: AI's Role and Market Dynamics

Energy Sector Outlook 2025: AI's Role and Market Dynamics  Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes