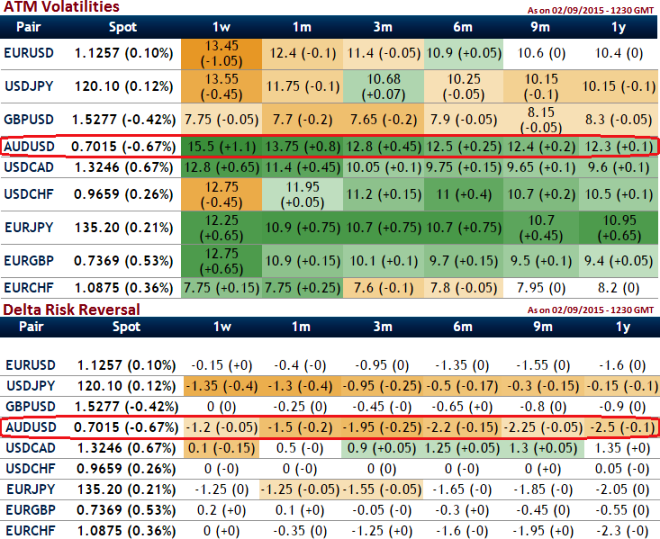

From the nutshells, it is understood that ATM vols and 25-delta risk reversals of AUDUSD the most expensive pair to be hedged for downside risks as it indicates puts have been over priced (downside protection is relatively more expensive). For the 3 months to 1 year time frame, delta risk reversal is getting closer to -2 to -2.55.

Volatility is better - AUDUSD is the highest volatile pair in next 3 months to 1 year (almost around 12-15%), the higher it is the higher the chances of big price movements. It means, theoretically, the market is expecting the price to move by 15%, either up or down, over certain time period. If AUD/USD is trading at 0.7030 and the IV of a 3M - 1Y option is 12.8, it means the market expects the price of AUD/USD to move either 12.8 above or below its current value in the next near future in a range from 0.6045 to 0.8014.

Options with a higher IV cost more. This is intuitive due to the higher likelihood of the market swinging in your favour. If IV increases and you are holding an option, this is good. Unfortunately, if you have sold an option, it is bad. A seller wants IV to fall so the premium falls. For an instance, setting up the below position has been quite difficult although it suggests healthy yields as short sides are risky venture.

2 lots of out of the money puts on long side and simultaneously an in the money shorts with slightly shorter maturity as this strategy to gain which is suitable in current downtrend AUD/USD. You should also note short-dated options are less sensitive to IV, while long-dated are more sensitive. The peaks suggest the option is expensive to buy and the troughs suggest the option is inexpensive. Using this strategy as the bearish environment piling up on this pair, we believe AUDUSD would radically drop, and want capital gains.

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings