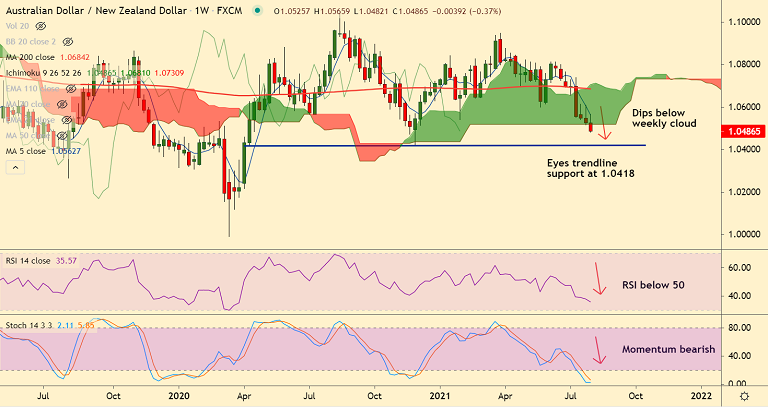

AUD/NZD chart - Trading View

Spot Analysis:

AUD/NZD was trading 0.46% lower on the day at 1.0484 at around 07:25 GMT

Previous Week's High/ Low: 1.0608/ 1.0516

Previous Session's High/ Low: 1.0565/ 1.0525

Fundamental Overview:

Blowout New Zealand jobs data cements RBNZ rate hike later this year, buoys the kiwi across the board.

New Zealand’s jobless rate dropped sharply to 4% in Q2, coming in much better than the 4.5% expected and compared to 4.7% prior.

On the other side, Aussie Retail Sales confirmed -1.8% MoM preliminary figures for July, versus +0.4% prior.

Further, China’s Services PMI for July rose past 50.3 to 54.9, keeping recovery hopes and boosting sentiment.

Challenging the market sentiment were the geopolitical tussles between the Western allies and Iran, as well as China. Escalating covid woes add to the misery.

Additionally, deadlock over US President Joe Biden’s $1.0 trillion infrastructure spending plan keeps traders wary.

Technical Analysis:

- AUD/NZD is extending downside for the 4th straight week

- Momentum is strongly bearish, Stochs and RSI are sharply lower

- Price action has slipped below the weekly cloud

- Volatility is high and rising as evidenced by widening Bollinger bands

Major Support and Resistance Levels:

Support - 1.0420 (Major trendline), Resistance - 1.0527 (5-DMA)

Summary: AUD/NZD trades with a strong bearish bias, further downside on cards. Scope for test of trendline support at 1.0420.