- AUD/NZD extends weakness for a second straight session, trades 0.43% lower on the day.

- Disappointing Chinese trade surplus data weighs for the second straight session on the Aussie.

- Weak China's trade surplus in May, primarily led by a sharp jump in imports, further weighed on the Australian Dollar.

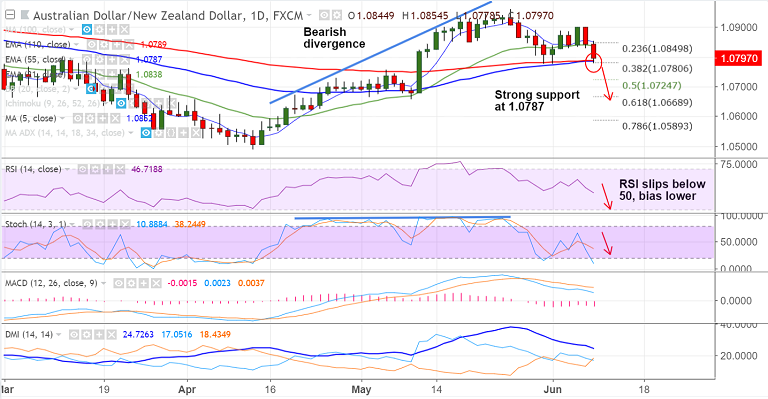

- Technical indicators are turning bearish. Stochs are biased lower and RSI has slipped below 50 levels.

- The pair finds major support at 1.0787 (nearly converged 55 and 110-EMA), break below will see further weakness.

- On the flipside, 5-DMA is immediate resistance. Close above will see resumption of upside.

Support levels - 1.0787 (nearly converged 55 and 110-EMA), 1.0724 (50% Fib), 1.07

Resistance levels - 1.08, 1.0838 (21-EMA), 1.0852 (5-DMA)

Recommendation: Good to go short on break below 1.0785, SL: 1.0840, TP: 1.0725/ 1.07/ 1.0670

FxWirePro launches Absolute Return Managed Program. For more details, visit http://www.fxwirepro.com/invest.