We expect the RBA to remain on hold for some time, but the RBNZ to ease again in either on April 27th or June.

Although, AUDNZD is experiencing little weakness for today, we think they are just momentary and these could rather be deemed as short term bear swings and better to use them as shorting opportunity in your hedging strategy. Expected RBA vs RBNZ direction, plus strong M&A flow into the AUD, favours AUD/NZD upside over the next few months to 1.1400+.

Technically, a stiff narrow range has come to an end after Yesterday’s support 1.1150 that has fueled the bounce upto 1.1239 levels. But at that juncture, the pair has been testing stiff resistance range at around 1.1250 to 1.1290 levels.

Although, the pair is struggling, the Chinese data (industrial production and GDP) and AU jobs data surprise should continue to resonate AUD in long run.

For now, if you compare the 1W ATM IVs with the call premiums of 1W tenors and technical swings in underlying spot FX, the prevailing bullish swings may not be having the strong momentum in rallies.

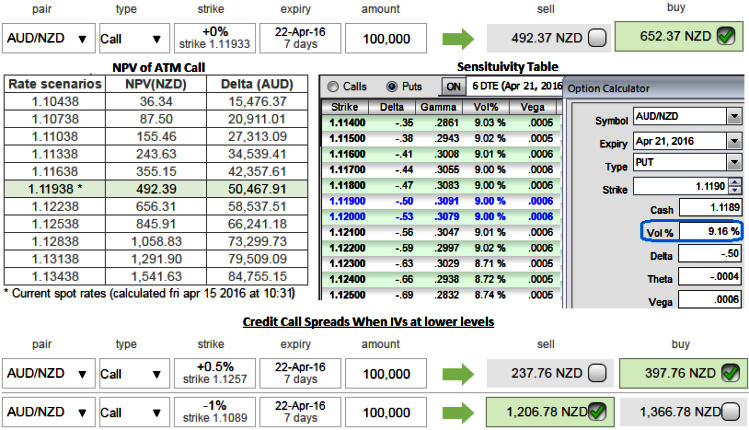

From above sensitivity table, one can see 1W ATM implied volatilities of this pair is just shy above 9%.

Whereas the premiums of ATM call of the same tenors are trading at 32.5% more that of Net Present Value. Thus, there exists a huge disparity between the pricing of the options and signals offered by OTC FX market of AUDNZD.

Hence, we could utilize this as opportunities for shorting overpriced calls in order to reduce the long term hedging cost of long positions in call options.

Subsequently, we recommend initiating shorts in 1W (1%) ITM call, and simultaneously 1 lot of 1M (0.5%) OTM call, thereby the strategy is to be executed at net credit.

The lower strike short calls because IV is on lower side and short term trend is slightly weaker and it finances the purchase of the higher striking call (ATM calls are overpriced, so we chose 0.5% OTM calls as well) and the position is entered for nill cost.

If market spikes dramatically our longs would likely arrest upside risks, else if it continues to drag the current dips even below in short run, then the initial premiums are to be pocketed for sure.

A seller wants IV to fall so the premium falls. You should also note short-dated options are less sensitive to IVs, so in this strategy we have short position suitable to both above conditions.

Low IV implies the market thinks the price will not move much and so that it is beneficial for option writers.

Best Gold Stocks to Buy Now: AABB, GOLD, GDX

Best Gold Stocks to Buy Now: AABB, GOLD, GDX  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed