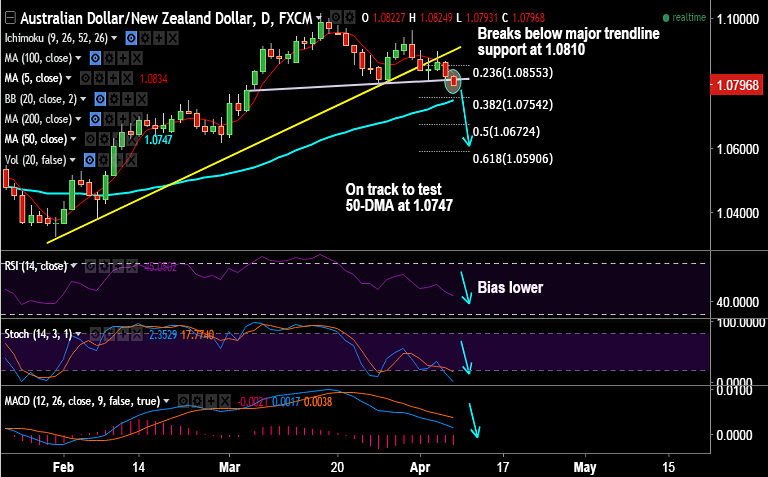

- AUD/NZD has broken major trendline support at 1.0810, bias lower.

- The pair now eyes next major support at 1.0747 (50-DMA), violation there could see test of 1.0698 (March 2 low).

- Aussie on the back-foot on a renewed risk-off in the markets after the US launched military strike on Syria.

- Risk assets such as equities, treasury yields, AUD etc. dumped, flight to safe-haven seen.

- Increased cautiousness in the wake of the Trump-Xi Summit to keep pressure on the Aussie.

- We see bearish invalidation only on close above 5-DMA at 1.0833.

Support levels - 1.0778 (March 6 low), 1.0754 (38.2% Fib retrace of 1.0326 to 1.1019 rally), 1.0747 (50-DMA)

Resistance levels - 1.0810 (trendline), 1.0834 (5-DMA), 1.0855 (23.6% Fib)

TIME TREND INDEX OB/OS INDEX

1H Neutral Neutral

4H Bearish Neutral

1D Bearish Neutral

1W Bearish Neutral

Recommendation: Good to go short on rallies around 1.080, SL: 1.0840, TP: 1.0775/ 1.0750/ 1.07

FxWirePro Currency Strength Index: FxWirePro's Hourly AUD Spot Index was at -114.306 (Bearish), while Hourly NZD Spot Index was at 23.6566 (Neutral) at 0540 GMT. For more details on FxWirePro's Currency Strength Index, visit http://www.fxwirepro.com/currencyindex.