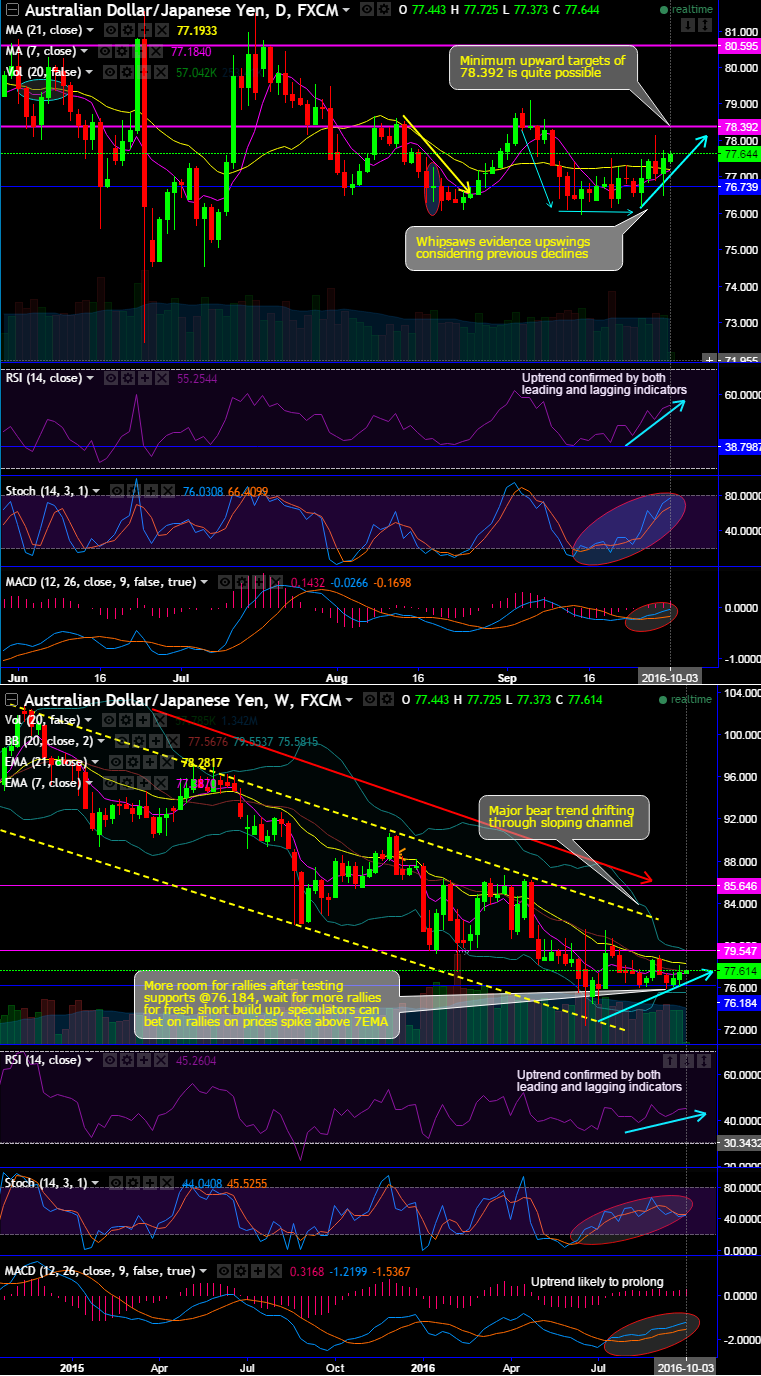

Ever since AUDJPY tested support at 76.075 levels, the swings have gone in whipsaws pattern, considering the previous declining trend, the price has spiked above DMAs on the daily chart.

The current upswing sentiments are likely to prevail and head towards next immediate resistance at 78.392 level that is where the bears have again snapped the recent gains at the same resistance levels in the last week.

You can figure out from daily plottings, the current prices have consistently remained well above DMAs from the last couple of days. Consequently, every attempt of recovery has been showing strength in the trend, as a result, 7DMA is likely to crossover above 21DMA.

Additionally, the leading oscillators on both daily and monthly charts, showing clear convergence with the prevailing upswings in prices; we believe this as bulls are getting boosted again. RSI is currently trending above 54 that have evidenced the strength in momentum in bullish sentiments.

MACD on both timeframes are signalling the uptrend continuation.

On the contrary, to understand the major downtrend, last month, during the convincing rallies of AUDJPY bears pulled back at 77.506 mark (strong resistance at 79.549 levels) but held firmly another important support at 76.184 levels on monthly charts, so thereby bull rallies began on 1st Jan seeing weakness back again to signify long term bear trend's momentum.

No shorts are encouraged at the current juncture; instead, we recommend waiting for more rallies for fresh short build up.

Intraday Option Trade Tips:

Well contemplating above technical reasoning, on intraday terms, the trade strategy would be the boundary binary options by using cash-or-nothing options for more upside targets and cushioned at DMAs.

Upper strikes – 78.125; lower strikes around 77.155 levels (i.e. 7-21 DMAs).

We used narrowed strikes, as the trading between these strikes likely to derive certain yields in the current uptrend and major downtrend (impact in near term is less), more importantly, these yields are exponential from spot FX.

For cash or nothing, these options would be exercised if the forward prices to remain between both strikes (i.e. 78.125 > Fwd price > 77.155).