On monthly plotting, shooting star occurred at 21EMA & stiff resistance of 87.609 (50% fibos), break above this may continue consolidation phase; failure swings likely to drop below 7EMA.

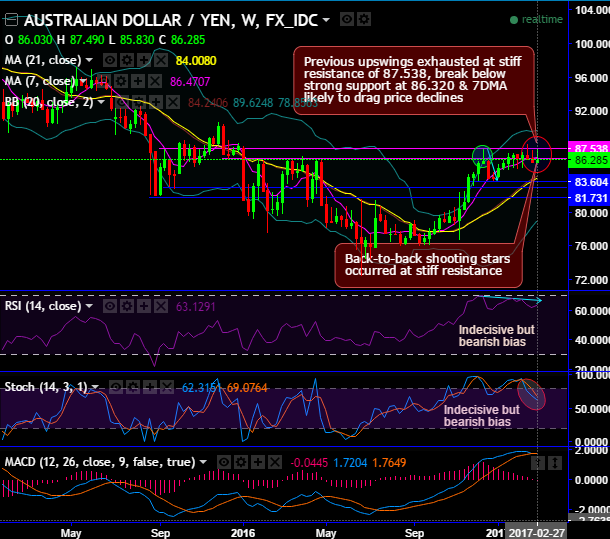

Even on weekly terms, Back-to-back shooting stars occurred at the stiff resistance of 86.320 levels.

Previous upswings exhausted at the stiff resistance of 87.538, break below strong support at 86.320 & 7DMA likely to drag price declines.

Thereby, after 6-7 months of consolidation pattern now seems to be exhausted at 50% of Fibonacci retracements from the lows of 72.437 levels (Jun’16 lows).

As you could probably make out the upswings on monthly plotting have exactly rejected at 87.533 which is almost 50% Fibonacci retracement levels.

As a result, a shooting star occurred at 84.249 levels at this Fib. level and 21EMA, that is where the leading oscillators (RSI) is also indicating overbought pressures at 70 levels, you observe the leading indicator whether it is gaining or struggling for strength in trend at this juncture (refer both weekly and monthly plotting).

Expect more dips as shooting star evidences slumps that break support below 7SMA.

Trade tips:

Well, contemplating above technical reasoning, on speculative grounds we advise tunnel spreads which are binary versions of the debit put spreads favoring bearish indications.

This strategy is likely to fetch leveraged yields than spot FX and certain yields keeping upper strikes at 87.538 and lower strikes at 85.047 levels.