- AUD/JPY struggles to extend gains above the 80 handle, bias is higher, we see scope for test of 80.85 (trendline).

- Aussie buoyed after RBA Board decided to leave the cash rate unchanged at 1.75 per cent and sounded confident about inflation returning to the target over a period of time.

- The Japanese Yen has failed to extend its last week's risk-aversion gains and is retreating broadly against most major currencies lending further support to the pair.

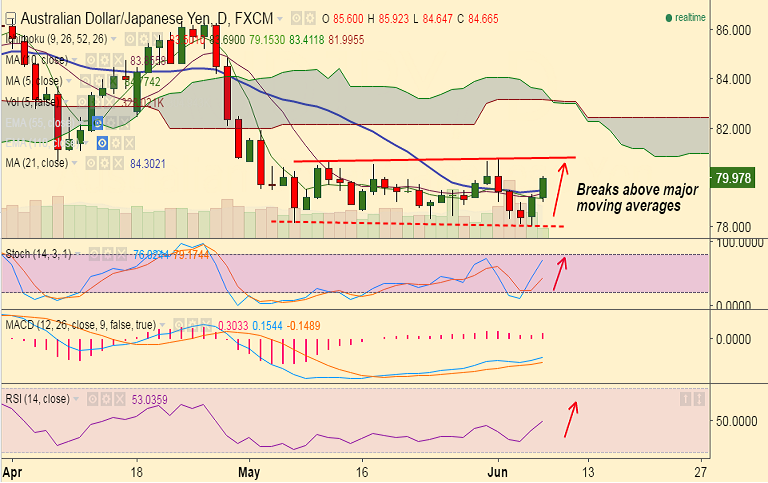

- The pair has broken above major moving averages (5-DMA @ 79.16, 10-DMA @ 79.34, 21-DMA @ 79.45).

- Next hurdle on the upside lies at 80.38 (May 12th highs) ahead of 80.56 (May 17th highs) and then 80.69 (May 31st highs).

- Weakness only on break below 79.45 (21-DMA), drag till 79 and then 78.70 likely.

- Focus on Chinese trade balance data, due tomorrow, and next week's BoJ's policy decision to determine the near-term direction for the pair.

Recommendation: Good to buy dips around 79.90, SL: 79.45, TP: 80.40/ 80.80