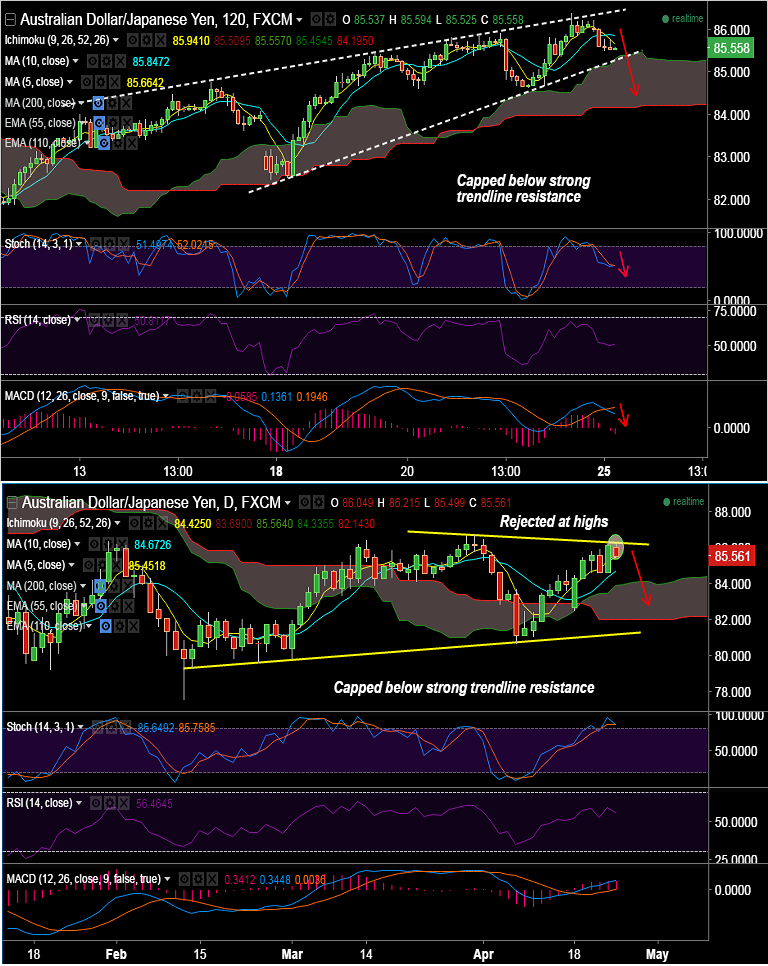

- AUD/JPY extended upside on negative yen fundamentals, but upside was capped at strong trendline resistance at 86.22.

- Markets nervous ahead of key central banks’ events along with a fresh batch of economic data lined up for release this week.

- Focus remains on FOMC, RBNZ and BOJ monetary policy decision due later this week.

- On the data front, China is set to release data on March industrial profits on Wed, while Japanese data on inflation, retail sales and unemployment are due Thurs.

- Technicals on 2H charts have turned bearish, pair on track to tests support at 85.25 levels.

- We see a bearish crossover on 5-DMA on 10DMA, Stochs have rolled over from overbought zone and MACD shows a bearish crossover on signal line.

- 2H cloud top at 85.14 is strong support, breaks below could see further downside upto 84.65 levels.

Recommendation: Sell rallies around 85.60/70, SL: 86, TP: 85.20/85/84.60