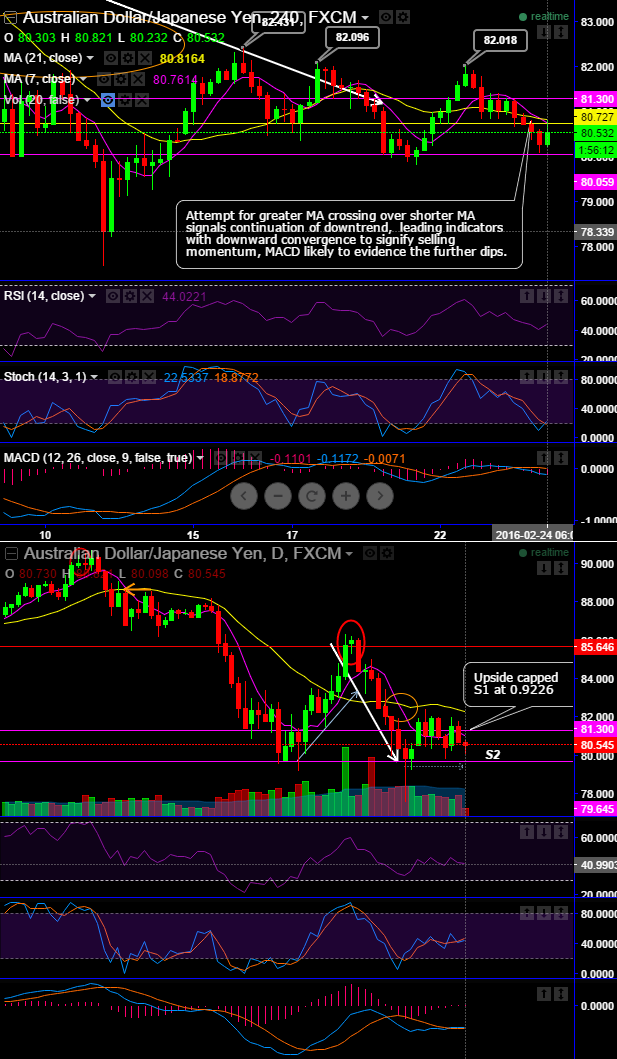

After the breach of support 81.300, the formation of triple top has been confirmed and we think the pair has gone more fragile to evidence more dips upto next strong supports at around 79.645 and may even retest all time lows again.

On intraday terms also it is lingering at resistance around 80.727 levels, that is where the attempt of 21MA crossing over 7MA and at this contraction the price has slid below moving average curves, as a result more weakness is anticipated in this pair at current stage.

Well, on daily terms, you can now figure out stiff pivot points at 81.300 on north and 79.645 on south. As and prices attempts to bounce it whipsaws on 7DMA and resultantly dropped below, this has been happening from last two weeks which means that the bulls have no interest in the pair to negotiate above this level.

More importantly, the leading oscillators like RSI and slow stochastic curves are bearish bias showing downward convergence to the dipping prices; we believe this as bears are getting highly active.

RSI is currently trending at around 42.1288 (while articulating) that has been showing downward convergence to the price dips.

In addition to that on stochastic curve it has reached oversold zone and showing %D crossover which means bulls in previous rallies have been exhausted and selling momentum is intensifying in overbought territory.

We could foresee the next crucial support is only at around 79.645 regions, if it does not manage to hold this level it may even drag up to all time lows again.

Trade recommendations:

Contemplating above technical reasoning, opting "One Touch Binary trades" would be a good speculating idea that are high-yield options associated with more inherent risk.

For the specific rationale, some traders choose to stay away from this type of trade (because trade objectives vary from person to person). However, there is no denying the appeal of exponential returns rates if you initiate binary delta puts and underlying begins moving towards 79.645, so these trades should not be completely overlooked. Instead, they should be executed when market conditions are ideal and should be used along with a solid strategy.

On delivery terms, one can eye on shorts in near month futures for targets towards 79.465 with a strict stop loss of 80.825, the reason for this is to carry the trade overnight providing more time for the underlying pair (near month contracts because it demands lesser margin to initiate trades in future contracts).

FxWirePro: AUD/JPY forms triple top, takes neckline support - speculate via one touch binary but stay short for delivery

Wednesday, February 24, 2016 8:15 AM UTC

Editor's Picks

- Market Data

Most Popular