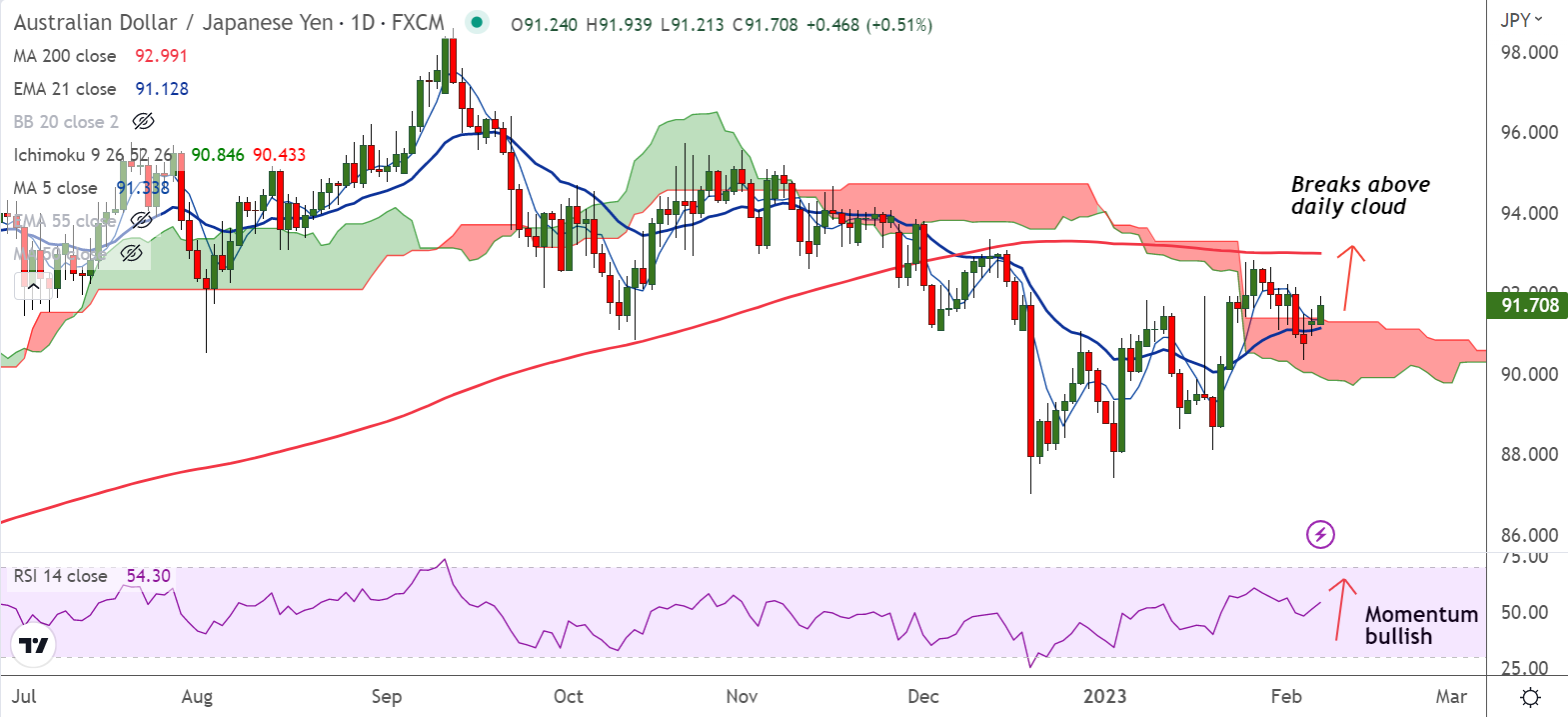

Chart - Courtesy Trading View

AUD/JPY was trading 0.51% higher on the day at 91.70 at around 06:10 GMT. Extends break above daily cloud.

Aussie soars after the Reserve Bank of Australia (RBA) raised interest rate by 25 bps as expected.

RBA matches the market forecasts, but the central bank failed to offer any major hawkish clues which keeps upside limited.

The central bank's statements expecting softer inflation moving forward and souring sentiment amid fears of escalating US-China tussles over the balloon shooting keep lid on gains.

Momentum is bullish and volatility is high. MACD and ADX supports upside in the pair. GMMA indicator has turned bullish on the intraday charts.

The pair has retraced dip below 21-EMA, price action hovers around 200H MA, decisive break above will fuel further gains.

Major Support Levels:

S1: 91.37 (cloud top)

S2: 91.12 (21-EMA)

Major Resistance Levels:

R1: 91.93 (110-EMA)

R2: 92.99 (200-DMA)

Summary: AUD/JPY has paused downside at 21-EMA. Price action has retraced above cloud top. Scope for upside resumption. 200-DMA at 92.99 in sight.